Kisan Vikas Patra (KVP): Features & Benefits

- Posted By Amritesh

- On May 19th, 2020

- Comments: no responses

Kisan Vikas Patra (KVP) is a one-time investment guaranteed return certificate scheme re-introduced in 2014. Maturity benefit is double of investment. Initially, KVP was launched primarily for farmers but now it is open for everyone interested in the scheme. The scheme is mainly targeted at the Individuals who do not have access to proper banking facilities and financial intermediaries. One more reason for re-introduction of KVP is to dissuade lower income group individuals from falling for any ponzi schemes and losing their hard earned money. The benefits offered under KVP is slightly different from other Small Savings Scheme offered by the Government with regard to rate of interest, tenure and benefits. It must be noted, investment in KVP is not eligible for Income Tax deduction and the interest earned is Taxable.

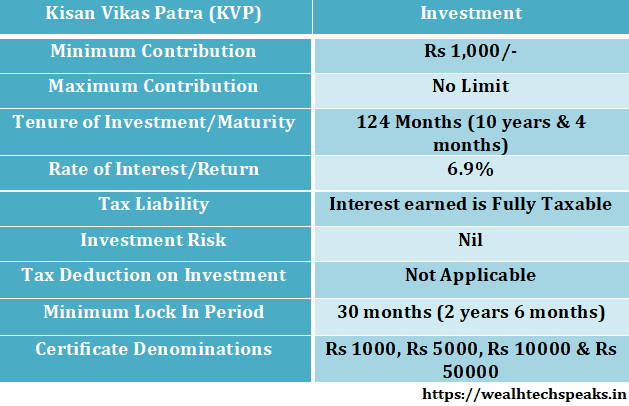

The interest on KVP is declared in Quarterly Basis. Currently, investment in KVP earns an interest of 6.9% and the tenure of the scheme is 124 months (10 years & 4 months). The rate is applicable on certificate purchased between 1st April, 2020 and 30th June, 2020. In the previous Quarter, interest on KVP was 7.6% and tenure of the scheme was 113 months (9 years & 5 months).

Small Savings Scheme Interest Rates FY 2020-21

KVP Scheme may be a viable investment option for risk-averse investors. However, when compared to NSC, PPF and some other Small Savings Schemes, KVP is not a very attractive investment option. Moreover, tax benefit is not available under the KVP scheme.

Kisan Vikas Patra (KVP): Key Features

Eligibility to Invest in Kisan Vikas Patra

Any Resident Individual for himself (18 years of age or above) or on behalf of a minor.

Any Two Resident Individual can also jointly invest in the scheme.

A Trust.

KVP Deposit/Investment Process

KVP certificate is available from Post Offices across India. One may also purchase the certificate from the designated Public Sector Banks.

Types of KVP Certificates: Kisan Vikas Patra (KVP)

Individual Certificate: Issued to an Individual for Self, on behalf of Minor, or to a Minor.

Joint ‘A’ Certificate: Issued jointly to two adults, payable jointly to both the holders or to the survivor.

Joint ‘B’ Certificate: Issued jointly to two adults, payable to either one of the holder or to the survivor.

Steps & Document Requirement to Invest in KVP

Individuals will have to conform to the KYC norms. Documents to be submitted are:-

Identity Proof (Passport, Pan Card, Driving License, Voter ID Card, etc)

Address Proof (Telephone & Electric Bill, Passport, Voter ID Card, etc)

Passport Size Photo

PAN Card is a must in case of Investment above Rs 50,000/-. Income proof is required for investment above Rs 10,00,000/- (10 lacs).

Application Form A, may be collected from the Post Office or Designated Bank. Form is also available online, same may be downloaded.

Duly Filled Form A, along with other documents needs to be submitted to the concerned authority. Following the verification of documents submitted, Investor needs to make the deposit in order to receive the KVP Certificate.

Mode of Investment

Payment can be made through Cash, Cheque or even Demand Draft. In case of cheque or demand draft the KVP certificate will be issued on the date of realization of the amount, but for cash payment it will be issued on immediate basis.

Nomination Facility

Nomination Facility is also available for the Individuals who prefer to exercise the option.

Transfer Facility

Option of Transfer of instrument from one post office to another or for that matter branch anywhere in India is also available.

Loan Facility

Loan may be availed from Banks by pledging KVP certificates.

Encashment and Payment on Maturity

KVP Certificates may be encashed from the Post Office/Branch it is issued. If it has been transferred elsewhere then from respective Post Office/Branch it may be encashed. The Maturity Amount will be directly credited to your Post Office Savings account or Bank account as the case may be.

Loss/Damage of Certificate

In case of Loss or Theft of the Certificate, an application along with Indemnity bond and identity slip needs to be submitted to the Issuing Post Office/Branch. On successful verification of the documents a duplicate Certificate will be issued.

In case of Destroyed/Mutilated/Defaced certificate, the same should be submitted and after successful verification of validity, fresh certificate will be issued.

Pre Mature Withdrawal of Kisan Vikas Patra (KVP)

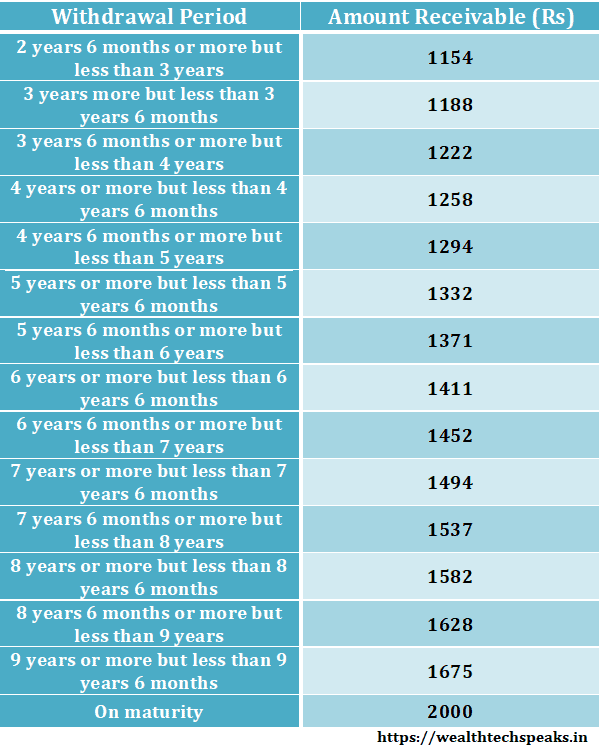

The certificate has a minimum lock in period of 30 months (2 years and 6 months) post which premature withdrawal is possible and investor will be paid according to the premature withdrawal table shared below.

However, premature withdrawal (before end lock in period) is also possible under the following circumstances:-

Death of the Certificate Holder or any of the holders.

On order by Court of Law.

Forfeiture by a Pledge being Gazetted Government Officer.

Amount Receivable on Premature Withdrawal (After 30 months for deposit of Rs 1,000/-)

Tax Implications

No tax deduction is available on the Investment made in the Scheme. The interest earned is fully taxable. However, Deposit is exempt from TDS at the time of withdrawal.

Maturity Amount

Investment doubles itself on maturity. It means if one invests Rs 1000/- then on completion of tenure, 124 months (10 years & 4 months, as per prevailing interest rate of 6.9% for the Quarter ending 30th June, 2020) the maturity amount will be Rs 2,000/-.

Post Maturity Interest

If the instrument is not redeemed on maturity, then the amount will earn simple interest at the rate applicable for Post Office Savings a/c.

Benefits of Investment in the Kisan Vikas Patra (KVP)

It assures fixed rate of return on Investment. The investment amount doubles on maturity.

The process of Investing in the Scheme is simple and easy.

It is one time Investment Scheme which means one is not required to make regular deposits.

Has a shorter pre-mature withdrawal period when compared with PPF and NSC.

Drawbacks of Investment in the Kisan Vikas Patra (KVP)

It does not provide Tax Benefit in anyway.

Interest Rate is marginally lower when compared to PPF and NSC.

Scheme does not provide any additional benefits over the other Savings Scheme like PPF and NSC.

Maturity Period is long when compared to NSC.

Better Investments options are available in the market.

Banks Fixed Deposits (FD’s) provide similar interest rate, on shorter duration term deposits.

About Kisan Vikas Patra (KVP): My Opinion

KVP is a good instrument for individuals who don’t have access to other Investment options. But when compared to other Guaranteed Investment products like PPF or for that matter even NSC, offer better returns and are tax efficient. Investment in Equity Linked Savings Scheme (ELSS) comes with shorter lock-in period and tax benefits. Furthermore, the return on ELSS is expected to be higher than KVP in the long run.

So, I recommend KVP only for Individuals who do not have the option to invest in ELSS, PPF or even in NSC.

Wealthtech Speaks or any of its authors are not responsible for any errors or omissions, accuracy, completeness, timeliness or for the results obtained from the use of this information. This article is for informational purpose only. Readers are advised to research further to have detailed knowledge on the topic. It is very important to do your own analysis and consult your Financial Advisor before arriving at any conclusion.