EPS vs NPS vs APY: Retirement Benefit Comparison

- Posted By Amritesh

- On July 18th, 2017

- Comments: 8 responses

Retirement Planning is not just about saving for the future rather it involves systematic approach towards accumulation of corpus which would be sufficient to meet the financial obligations post retirement. Individuals may avail various retirement plans provided by the Insurance Companies or invest in Mutual Funds or Public Provident Fund (PPF) which provides lump sum or regular income post retirement. However, many are often confused or not aware of the probable retirement benefit plans which they can avail. Government is also very serious regarding the same as it wants individuals to plan for the retirement while they are young and earning. It has launched various schemes and created awareness about it so that more and more individuals avail those schemes and provide themselves with a regular source of income after retirement. Comparison of Retirement Plans to help Individuals to understand the retirement benefits better.

In my previous posts I have discussed in detail about the various Government initiated pension schemes. Now, let’s compare these notable Pension schemes and find out which one is provides better benefits as compared to others. Please click on the link below to know more about the schemes.

Comparison of Retirement Plans

Employees’ Pension Scheme (Series-1)

National Pension Scheme (Series-1): All Citizen Model

Atal Pension Yojana (Retirement Plan)

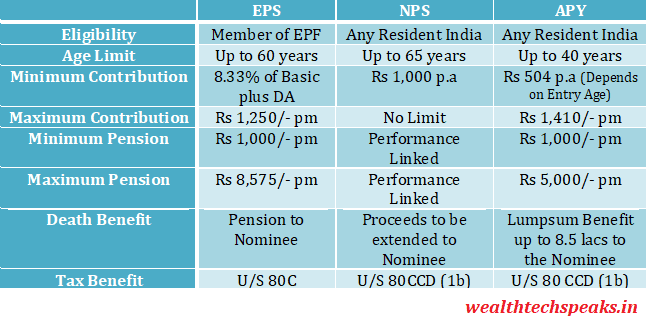

Employees’ Pension Scheme (EPS)

Subscriber to Employees’ Provident Fund (EPF) is mandatorily covered under the Employees’ Pension Scheme (EPS). Individuals earning wages/salary above Rs 15,000/- per month have the option to opt out of EPF. Employees’ Pension Scheme provides pension to the subscriber post retirement based on the years of service and contribution made under the scheme. The minimum pension under the scheme is Rs 1,000/- pm and maximum pension which may be provided under the scheme is Rs 7,500/-. However, one may defer your pension withdrawal for 2 years to earn additional hike of 8.16% on actual pension.

National Pension Scheme is open to all the citizens of India and anyone above the age of 18 years can invest in the scheme. It is a market linked scheme and return on the investment is dependent on the performance of the fund. Individuals have the option to choose from the preferred class of investment and designated portfolio manager manages the funds. On attaining the age of 60, Individuals may withdraw the lump sum but will have to mandatorily invest 40% of the proceeds in purchasing an annuity plan which will provide regular income to the individual. The return on investment is expected to be somewhere between 10%-12%. Individuals may open an account in any of the nationalized banks.

Atal Pension Yojana (APY) was launched by the Government keeping in mind the interest of the lower income group. The scheme is open for individuals aged between 18-40 years. The scheme provides maximum pension of Rs 5,000 per month after the age of 60 years. It is very simple to subscribe for the scheme and contribution is auto debited from the respective bank account of the individual. It is one of the cheapest retirement benefit plan available which offers decent return to the subscribers.

The return on investment comes to be around 8% approx.

Some Key Aspects of the Schemes

Comparison of Retirement Plans: Which is a better Retirement Plan?

Comparison of Retirement Plans: Which is a better Retirement Plan?

Each of the above mentioned schemes have their share of benefits and flaws. But if you take the whole product into consideration, I would prefer the National Pension Scheme (NPS) over the other two pension schemes. You may read my previous articles to know more about the respective schemes.

Benefits Under Employees’ Pension Scheme (Series 2)

National Pension Scheme (NPS): Benefits and Drawbacks (Series-2)

Atal Pension Yojana: Indepth Analysis

Employee Pension Scheme (EPS) is a decent pension plan but the return in my opinion is quite poor as compared to other schemes. Pension amount is also restricted which may not be sufficient. The minimum pension of Rs 1,000 is also pretty low for present market scenario. EPS also does not offer any lump sum benefit to the nominee.

Atal Pension Yojana (APY) is the most affordable pension among the three, with an annual premium as low as Rs 504/- per annum. However, the pension is restricted to maximum of Rs 5,000/- which may not be sufficient with the rising expenses. In case of death of the policy holder, the nominee will get a lumpsum of upto Rs 8.5 lakhs depending on the premium and pension plan subscribed.

National Pension Scheme (NPS) is also a very affordable scheme and is one of the well balanced products launched by the Government. Investment in the fund may be diversified in various Classes of Investment based on the appetite of an Investor to take risk. The return on the investment is expected to be decent as Fund is managed by professional fund managers. At the time of retirement the entire corpus will be paid to the Individual of which 40% mandatorily needs to be invested in purchasing a purchase plan while rest may be withdrawn as lumpsum. The scheme offers the best return among all the 3 retirement plans and offers greater flexibility as compared to the other two.

Individuals are advised to consult their Financial Investors before investing.

very good submit, i actually love this web site, keep on it

Thanks for your publication. One other thing is that often individual states in the United states of america have their particular laws that affect home owners, which makes it very hard for the the legislature to come up with the latest set of rules concerning property foreclosures on house owners. The problem is that a state possesses own laws which may have interaction in an unwanted manner when it comes to foreclosure guidelines.

Hey, you used to write magnificent, but the last few posts have been kinda boring? I miss your great writings. Past several posts are just a bit out of track! come on!

Hello There. I discovered your weblog using msn. This is a very well written article. I will be sure to bookmark it and return to learn more of your useful information. Thank you for the post. I will definitely comeback.

According to my observation, after a the foreclosure home is available at a bidding, it is common to the borrower in order to still have the remaining balance on the loan. There are many loan companies who seek to have all service fees and liens paid back by the following buyer. However, depending on particular programs, restrictions, and state regulations there may be several loans that are not easily sorted out through the exchange of financial loans. Therefore, the obligation still lies on the consumer that has obtained his or her property in foreclosure process. Thank you for sharing your ideas on this blog site.

certainly like your web site but you have to check the spelling on several of your posts. Several of them are rife with spelling problems and I find it very bothersome to tell the truth nevertheless I?ll certainly come back again.

Throughout the grand pattern of things you get an A+ for hard work. Where exactly you confused us ended up being in the specifics. You know, it is said, details make or break the argument.. And that couldn’t be much more accurate right here. Having said that, let me say to you just what exactly did deliver the results. The article (parts of it) is actually quite persuasive which is probably the reason why I am making an effort in order to comment. I do not make it a regular habit of doing that. 2nd, while I can certainly notice the leaps in logic you make, I am not convinced of exactly how you appear to unite the ideas which inturn produce your final result. For now I will, no doubt subscribe to your issue however hope in the near future you actually connect your dots better.

One thing I’ve noticed is there are plenty of myths regarding the banking companies intentions whenever talking about property foreclosure. One misconception in particular is the fact that the bank needs to have your house. The lending company wants your hard earned dollars, not your house. They want the bucks they lent you along with interest. Avoiding the bank is only going to draw any foreclosed realization. Thanks for your article.