Saral Jeevan Bima Yojana : Term Life Insurance

- Posted By Amritesh

- On February 1st, 2021

- Comments: one response

Insurance Regulatory Authority of India (IRDAI), the insurance regulatory has issued guidelines pertaining to the ‘Standard Term Life Insurance”. As per the mandate, plan will be offered by all the Life Insurers. Saral Jeevan Bima Yojana is launched with standard terms & conditions, offering pure risk life insurance cover. IRDAI has introduced the plan with simple features to make it easy for the Insurers looking for an affordable Term Plan. The aim of the insurance regulators is to provide a standard product with transparency and eradicate mis-selling prevalent in the segment. Individuals may easily choose the “Term Plan” based on their financial goals and at an affordable premium. Life Insurance have been asked to launch the plan on or before 1st January, 2021.

Standard Term Insurance plan is introduced keeping in mind the increasing demand among the Individuals to avail pure term life insurance products. Currently, many term plans are available in the market. Insurers offer wide range of term plans with additional features, benefits and riders. The terms and conditions of such products also differ from one insurer to another. Individuals are unable to take an informed decision as availability of wide range of products creates confusion, increasing chances of mis-selling. This exposes Investors to the risk of ending up with inadequate coverage or missing out on the right product.

Saral Jeevan Bima Yojana comes with standard terms and conditions offering basic coverage which is adequate to meet the requirement of majority of policyholders. A standard product eradicates confusion in the minds of the investors, Customers are able to easily understand the benefits offered and coverage the require for themselves.

Standard Term Life Insurance Product: Saral Bima Yojana

#Standard Term Life Insurance plans to be called, “Saral Jeevan Bima Yojana”; Insurers name will be prefixed to the plan name.

#Standard Terms & Conditions along with Features will remain identical for the product across all Insurers.

#Standard Term Life Insurance plans is offered by all the Life Insurers from 1st January, 2021 as per the IRDAI mandate.

#’Saral Jeevan Bima’ Yojana is a non-linked, non-participating, individual pure risk premium life insurance plan, providing Sum Assured as lumpsum to the nominee in case of unfortunate demise of the Policyholder during the course of the policy.

#Minimum coverage under the plan is of Rs 5 lacs, while maximum coverage is set at Rs 25 lacs. However, Insurer have the option to offer higher insurance cover but without altering the terms & conditions of the plan.

#Policy premium will be set by the Insurers based on the Tenure, Policy Cover, Age of the Policyholder, etc.

#Benefits & Riders will be strictly restricted to the ones stated in the Annexure, no additional option will be available. However, death due to suicide will be excluded from the coverage.

#Product will be offered to the Individuals, without any discrimination based on gender, place of residence, travel, profession or educational qualification.

#Insurers will have to abide by the regulatory guidelines issued for the product.

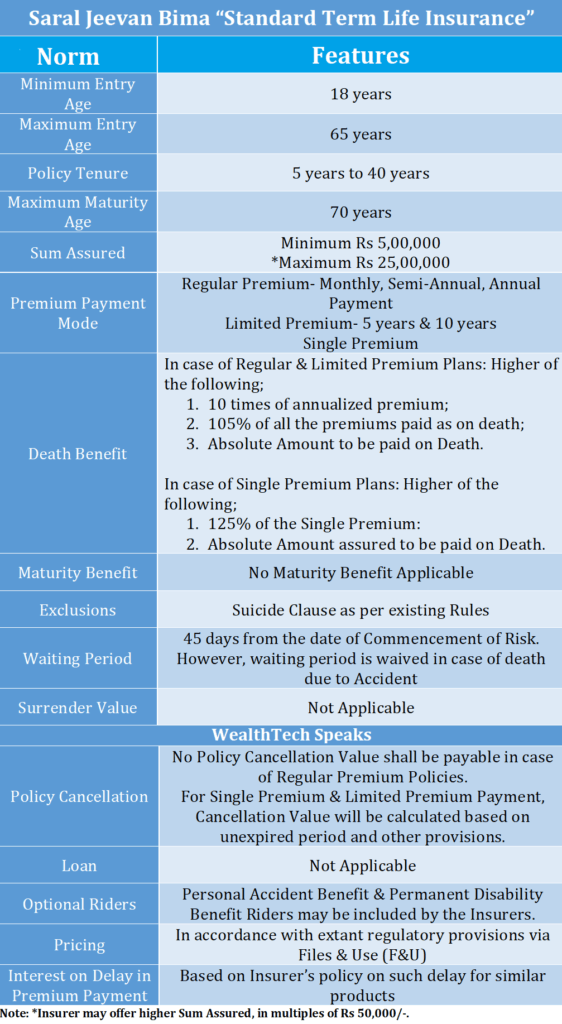

Features, Benefits & Coverage under the Standard Term Plan

Saral Jeevan Bima Yojana “Standard Term Life Insurance”: Review

Saral Jeevan Bima Yojana is a simple pure insurance product. It comes with standard terms & conditions making it easy even for a layman to understand the coverage & features under the policy. The benefits are clearly defined and only exclusion is on account of suicide, as per extant regulations. This implies that the cover will not be available for the initial period. Currently, the policy premium is fairly high as compared to similar Term Life plans offered by the Insurers. The plan is intended towards the first-time/entry level proposers and Individuals who do not have access to such Term Life plans. Since the product is fairly new, Insurers are still in the process to identify the potential mortality rate among the proposers.

Individuals who already own a Term Life Insurance cover may skip the Saral Bima Jeevan. The coverage offered may not be enough to meet the financial obligations. The premium levied also appears to be comparatively higher. Saral Jeevan Bima Yojana is ideal for Individuals, not covered under any other term plan or qualify for the same.

The policy is introduced to deepen insurance penetration. But steep premium will dissuade many to avail the product. However, the policy is intended for the larger section of the society and does not have any serious restrictions. Moreover, the policy offers minimum coverage of Rs 5 lacs along with minimum tenure of 5 years. The same features are not available in other Term Plans. So, Individuals looking for basic cover may consider the new plan. It is just the initial stages of the new term plan and will surely evolve over a period of time.

Types of Life Insurance Plans

Wealthtech Speaks or any of its authors are not responsible for any errors or omissions, accuracy, completeness, timeliness or for the results obtained from the use of this information. This article is for informational purpose only. Readers are advised to research further to have detailed knowledge on the topic. It is very important to do your own analysis and consult your Financial Advisor before arriving at any conclusion.