Pension Calculation Under Employees’ Pension Scheme

- Posted By Amritesh

- On December 1st, 2018

- Comments: 164 responses

Employees’ Pension Scheme (EPS) was introduced to provide pension cover to EPF Subscribers on attaining the age of 58 years. However, the amount of pension is determined based on the pensionable service and contribution period of the Subscriber, subject to minimum pension of Rs 1,000/- per month. I have already posted article on Benefits available under the Employees’ Pension Scheme. In this post I will discuss the process related to Pension Calculation. One may refer to my earlier posts related to EPS in the link provided below:-

Higher Pension Under EPS For Members

Employees Pension Scheme (Series-1)

Benefits Under Employees’ Pension Scheme (Series-2)

Employees’ Pension Scheme (EPS): Increase Your Pension with Deferred Withdrawal

Pension Calculation, In case of New Entrants:- (Joining Service After 15.11.1995)

Monthly Superannuation/Early Pension = Pensionable Salary X Pensionable Service /70

Pensionable Salary shall be limited to Rs 15,000/- per month as per notification dated 01/09/2014. The same is set aside as per the ruling on 1st April,19, clarification is awaited.

Pensionable Salary was hiked from Rs 5000 w.e.f 01/06/2001 to Rs 6500 and continued till 31/08/2014.

While calculating Pensionable Salary we have to take the average of monthly pay drawn during 60 months preceding the date of cessation of membership. As of 1st April 2019, the Pensionable Salary is to be calculated on last 12 months salary.

In case of early pension, the amount of pension shall be reduced by 4% for every year the age fall short of 58 years.

If an individual has rendered Pensionable Service for 20 years or more, than his/her pensionable service will be given an additional weightage of +2.

Minimum Pension is fixed at Rs 1000/- per month.

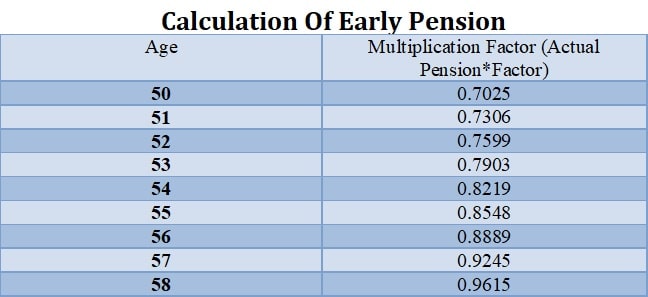

Calculation of Early Pension (Age 50 -57 years)

The pension will reduced by 4% for each year falling short of the stipulated 58 years. The actual pension should be multiplied by following factor to arrive at the actual pension which may be received by the Subscriber.

Deferred Pension (On Attaining 58 years till 60 years of Age)

Individuals may now defer their Pension till the age of 60 years with or without contribution to EPS Fund. The deferral of pension for 1 year will ensure hike of 4% while 2 years deferral will provide 8.16% hike on the actual pension amount.

Contribution made by the Subscribers during the deferral period will be used for calculating the Pensionable Service and Contribution Period. In case of Non Contributory Deferral, the Subscribers will still be eligible for 4% or 8.16% increase as per the opted deferral period. But same would not be considered to determine the Pensionable Service or Contribution Period.

Furthermore, the deferred period will not be considered for determining the eligibility for Pension.

Members Not Complying With Eligible Service Years For Pension

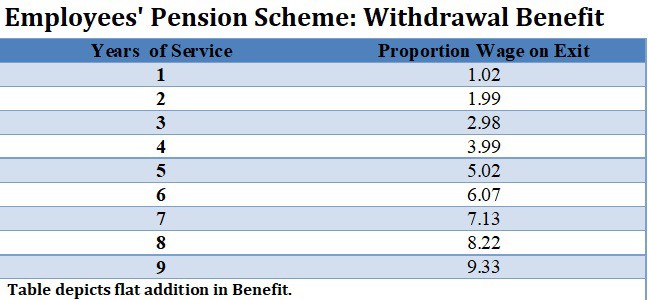

Members who have not completed eligible service years for pension on date of cessation of membership, or on attaining 58 years of age whichever is earlier, he/she shall be entitled to withdrawal benefit. In case, Individual has not attained 58 years of age, he/she may opt for scheme certificate which would entitle him/her for member’s pension subject to fulfillment of eligibility criteria.

Withdrawal Benefit entitlement will be as per the table shared below.

Commuted Pension (Discontinued since 2008)

A member is eligible to Pension under the scheme, may opt on completion of 3 years from commencement of scheme to commute maximum of 1/3 rd of his/her pension so as to receive 100 times the monthly pension so commuted while the balance pension will be paid on monthly basis.

But Commutation of pension has been discontinued and Subscribers no longer have the option to commute 1/3 rd of their pension.

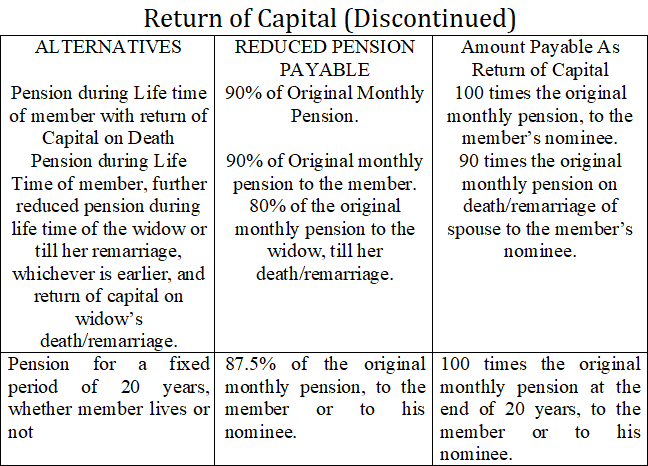

Return of Capital (Discontinued since 2008)

A member may opt to draw Reduced Pension and avail Return of Capital under following alternatives.

Return of Capital provision has been discontinued through Amendment to the EPS,’95 in 2008.

Pension on Permanent or Total Disablement

A member, who is permanently or totally disabled during the employment shall be entitled to pension subject to minimum pension of Rs 1,000/- per month, notwithstanding the fact that he/she has not rendered the pensionable service provided that he/she has made at least one month’s contribution to the pension fund.

Details are covered in the post covering Benefits Under Employees Pension Scheme.

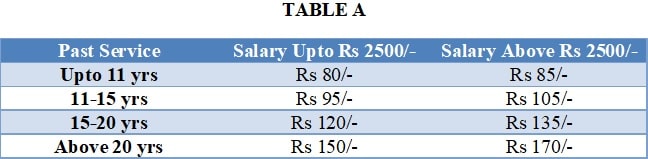

Pension Calculation for the Period before 15.11.1995 (Family Pension Scheme, 1971)

Pre 15.11.1995 the following procedure was adopted to calculate the pension.

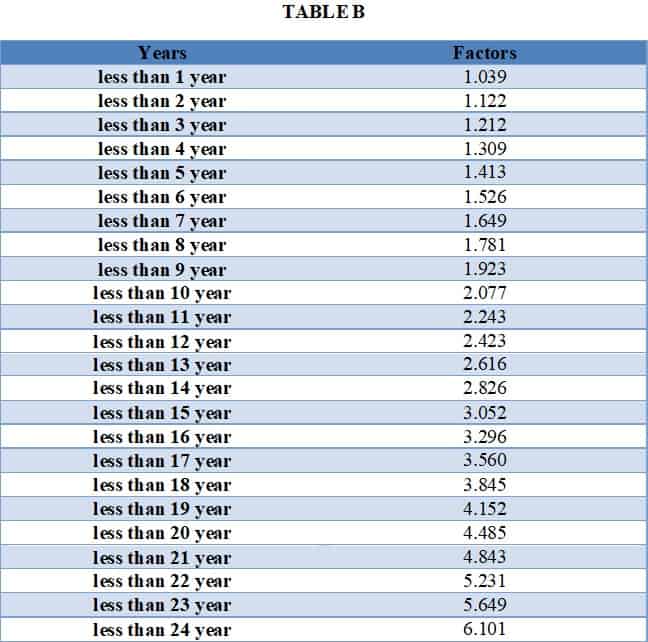

The above amount is the benefit payable on completion of 58 years of age as on 16.11.1995. For the calculation of pension benefits before 58 years (if a member do not complete 58 years of age on 15.11.1995, his past service benefit will be increased by the below factor – Early pension cases ) the above benefit is multiplied by the TABLE- B factor to arrive at the past service benefit.

Pension Calculation

Pensionable Salary X Pensionable Service

70

subject to minimum of Rs.335, Rs. 438, Rs.635 for receiving early pension ( before 58 years) for date of commencement of pension between 01/04/1993 and 15/11/2000, 16/11/2000 and 15/11/2005, 16/11/2005 respectively

AND

subject to minimum of Rs.635, Rs.438, Rs.335 for receiving pension on or after 58 years for date of commencement of pension between 01/04/1993 and 15/11/2000, 16/11/2000 and 15/11/2005 , 16/11/2005 respectively.

(If member has joined after 15.11.1995, only Pensionable Service Benefit is applicable)

Proportionate reduction: Arises if the past service is less than 24 years and aggregate pension calculated is less that Rs.500/-.

Currently, Minimum Monthly Pension Prescribed to the Member is Rs 1,000/-.

Illustration:- Pension Calculation

Date of Birth: 01/01/1960

Date of Joining: 01/01/1985

Salary as on 15/11/1995: Above Rs 2500/- per month.

Salary on Completion of 58 years as on 01/01/2018: Rs 15,000/-.

Past Service Approximately: 10 years (rounded off)

Compensation: Rs 85/-. (For Past Service as per Table A)

Factors as per Table B (difference between 01/01/2018 and 15/11/1995): 5.649

Past Service Benefit (Table A x B): Rs 85 x 5.649= Rs 480.165

Pensionable Service from 15/11/1995): 22 years

Additional Weightage: 2 years

Pensionable Salary: Rs 15,000/-.

Pension Admissible: 15000 x 24/70 = Rs 5142/-

Total Pension: Rs 5142+Rs 480 = Rs 5,557/-. (approx).

Note:- Pensionable Salary comprises of average of last 60 months salary, thereby in the above illustration it will include Rs 6500 for first 12 months which has been ignored to make the calculation simple and easy to understand.

As of 1st April, 2019, the Pensionable Salary calculation on last 60 months salary has been set aside. Thus 12 months salary needs to be considered. However, the clarification from EPFO is awaited.

Illustration 2.) Pension Calculation

Date of Birth: 01/01/1960

Date of Joining: 01/01/2005

Salary on Completion of 58 years as on 01/01/2018: Rs 20,000/-. (Basic Salary)

Salary as on 31/08/2014: Rs 12,500/-. (Basic Salary)

Pensionable Service Years: 13

Pensionable Salary (Average Salary of 60 months) :

Till 31/08/2014: 20 months * Rs 6,500= Rs 1,30,000/-

Till 31/12/2017: 40 months * Rs 15,000= Rs 6,00,000/-

Pensionable Salary: 7,30,000/60= Rs 12,167/-.

Pension Receivable: 12,167* 13/70= Rs 2,260/- (rounded off)

This article is for informational purpose only. The blog does not claim accuracy of the facts or calculation shown. Readers are advised to research further to have more clarity on the topic. It is very important to do your own analysis and consult your Financial Advisor before arriving at any conclusion.