Union Budget 2021 Key Highlights

- Posted By Amritesh

- On February 4th, 2021

- Comments: one response

Union Budget 2021 was presented on 1st February, 2021 (Monday) in the parliament by the Hon’ble Finance Minister Nirmala Sitharaman. In the speech, Finance Minister stated that the Budget proposals focuses on six pillars; “Health & Wellness, Physical & Financial Capital and Infrastructure, inclusive development for aspirational India, reinvigorating human capital, innovation and Research & Development, and Minimum Government & Maximum Governance”. In this post, we glance through the Union Budget 2021 Key Highlights.

Union Budget 2021-22 comes at a time when the Indian economy is under stress due to the pandemic which has adversely impacted the businesses globally. The emphasis of the Budget proposals was on Infrastructure development and uplifting Health facility. The primary concern for the Government is to revive the economy and generate jobs for the young generation. Government’s push to develop domestic facilities for realization of “Atmanirbhar Bharat” was also evident in the budget.

However, the middle class do have reasons to be disappointed as no relief in terms of direct tax was announced. The current tax system will be applicable in the next financial year as well.

Union Budget 2021 Key Highlights

#Fiscal Deficit stands at 9.8% of the GDP for the current Financial Year. The estimated fiscal deficit for the FY 2021-22 is pegged at 6.8%.

#Government expects to reduce the fiscal deficit gap to 4.5% by FY 2025-26.

#Allocation of approximately Rs 2,23,846 crores on Healthcare, massive 137% jump from the previous Budget.

#Rs 35,000 crore allotted for Covid-19 vaccination.

#Agri Infra Cess imposed on Petrol @Rs2.5 per liter and on Diesel @Rs 4 per liter.

#100% Cess imposed on Alcohol.

#LIC IPO and strategic disinvestment of BPCL, Air India, Shipping Corporation of India, IDBI Bank, Container Corporation of India planned for the FY 2021-22.

#Increase of FDI in the Insurance Sector from 49% to 74%.

#Consolidation of Provisions of SEBI Act, Depositories Act, Securities Contracts Regulations Act and Government Securities Act.

#Introduction of Development Financial Institution (DFI) with market cap of Rs 20,000 crores, with the aim to have Rs 5 lakh crore lending portfolio in next 3 years.

#Ujjwala Scheme to be extended, cover 1 crore new beneficiary.

#More Economic Corridors to come up.

#Promote Digital Payment in the Country.

#First Digital Census to be carried out in the Country.

#Encouragement to the Startups; tax holiday for startups has been extended by one more year up to 31st March, 2022.

#One Person Company allowed to grow without any restrictions on paid up capital and turnover.

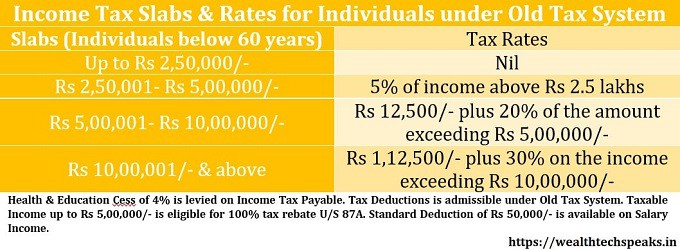

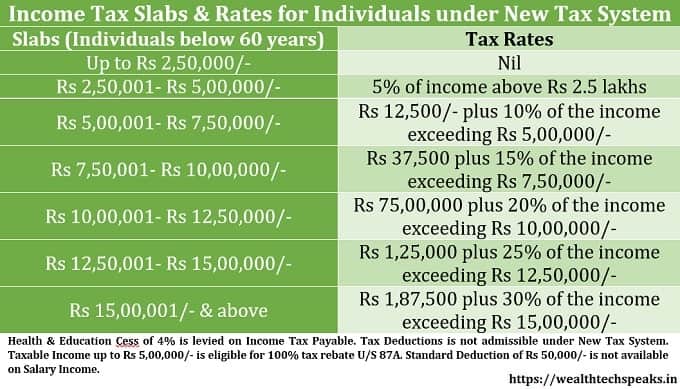

#Direct Tax Rates remain unchanged for the Financial Year 2021-22.

#Implementation of four Labour Codes to ensure Social Security, Minimum Wages & ESIC Benefits.

#Relief from double taxation for non-resident Indians (NRIs) on funds accrued in foreign retirement accounts.

Union Budget 2021 Key Highlights: Direct Tax

#Pensioners aged of 75 years or above, only having pension & interest as source of income are to be exempted from filing income tax returns.

#Dispute Resolution Committee to be setup from Small Tax Players.

#Interest Earned on Provident Fund contributions in excess of Rs 2.5 lakhs in a Financial Year will now be taxed under normal tax norms.

#Tax Deductions U/S 80EEA for first time home buyers is extended till 31st March, 2022.

#Tax Forms will be made simpler for the Tax paying Individuals.

#High Premiums paid in Unit Linked Insurance Plans (ULIPs) in excess of Rs 2.50 lakhs will not be eligible for exemptions u/s 10 (10D).

Income Tax Slabs & Rates for Financial Year 2021-22

Budget 2021: My Opinion

The focus of the Budget is on economy recovery and generation of job opportunities. Budget also lays stress on upgrading the Healthcare and Infrastructure facilities, as it is crucial for the economy. The Direct Tax rates remain unchanged, despite the challenges is a relief for the taxpayers. However, Senior Citizens above the age of 75 years receiving Pension & Interest on Deposits, as only source of income are exempted from filing Income Tax Return.

Overall, the Budget holds promise as it aims to address the crisis and at the same time create jobs for the youth. The focus is also on improving health facilities and infrastructure. “Aatmanirbhar” & “Make in India” concept will propel Indian economy to new heights.

Note: Please do subscribe to WealthTech Speaks YouTube Channel & our Blog to show your support for us.

WealthTech Speaks or any of its authors are not responsible for any errors or omissions, accuracy, completeness, timeliness or for the results obtained from the use of this information. This article is for informational purpose only. Readers are advised to research further to have detailed knowledge on the topic. It is very important to do your own analysis and consult your Financial Advisor before arriving at any conclusion.

Does your site have a contact page? I’m having problems locating it but, I’d like to shoot you an e-mail. I’ve got some creative ideas for your blog you might be interested in hearing. Either way, great website and I look forward to seeing it improve over time.