Union Budget 2020: Highlights

- Posted By Amritesh

- On February 5th, 2020

- Comments: 9 responses

Union Budget 2020 was presented by the Finance Minister Nirmala Sitharaman in the parliament on 02nd Feb, 2020. The longest ever Budget speech came with key announcements aimed at reviving economy and increasing the purchasing power of the Indians. Personal Income Tax has undergone significant change and in some ways it has become complicated for the common man. However, detailed analysis of the budget and its implications pertaining to Personal Finance & Direct Tax will be done shortly. In this post focus is on the key announcements in the Budget 2020.

Highlights of Union Budget 2020

#Fiscal Deficit revised to 3.8% from earlier projection of 3.3% for Financial Year (FY) 2019-20. Target for FY 2020-21 set at 3.5%

#Nominal GDP growth pegged at 10% for FY 2020-21. The Economic Survey 2020 has forecasted economic growth at 6%-6.5% in FY 2020-21.

#Govt to sale part of its holding in Life Insurance Corporation of India (LIC) via Initial Public Offering (IPO).

# Expenditure pegged at Rs.26.99 lakh crores. Total Expenditure at estimated at Rs.30.42 lakh crores

#Receipts estimated at Rs.19 lakh crores

#Net Market Borrowing target Rs.4.99 lakh crores

#60 lakh new Tax Payers added with introduction of GST.

#Deposit Insurance and Credit Guarantee Corporation (DICGC) permitted to increase deposit insurance coverage for a depositor which is now standing at Rs 1 lakh to Rs 5 lakh per depositor.

#Rs.9500 crs allocated for Sr. Citizen and Handicapped.

# Commitment of doubling farmers income by 2022.

#6.11 Crore farmers insured under “PM FASAL BIMA YOJANA”.

# Rs.69000 crs allocated for Health Sector.

#Rs.28600 crs allocated for Women centric programs.

# Rs.99300 crs allocated for Education sector.

#Dividend Distribution Tax (DDT) is abolished. Dividends will now be taxed in the hands of the recipients.

# Foreign Portfolio Investors (FPI) investment in corporate bonds to be increased from 9% to 15%.

#Sovereign Wealth Funds investments in Infra and other notified Bonds with minimum 3 years lock in period, exempted from Tax on Dividend and capital Gains on investments up to 31st March 2024.

# Micro, Small & Medium enterprises (MSMEs) turnover threshold for audit increased to Rs 5 crores from Rs 1 crore.

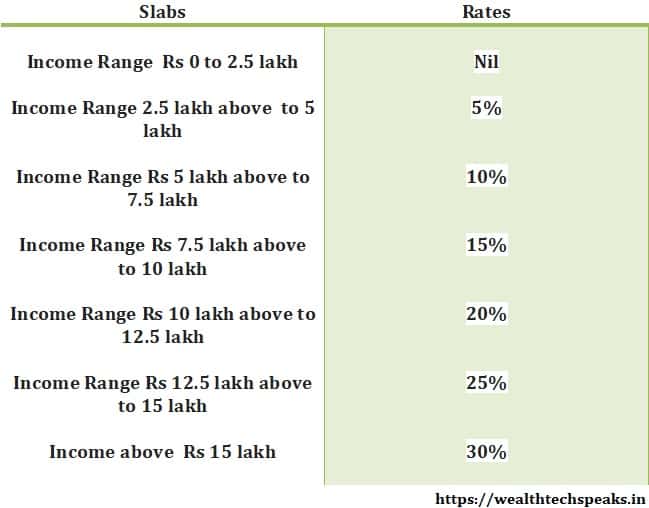

Income Tax Slab Rates for the Financial Year 2019-20

#Income Tax Slabs revised, provided no Deduction is claimed under Chapter VIA of the Income Tax Act.

#Previous FY Income Tax to prevail in case deductions under Chapter VIA of the Income Tax is claimed.

#New Tax Slab is only applicable, if notable Deductions are not claimed.

New Income Tax Slabs & Rates, provided notified Tax Deductions is not availed

This article is for informational purpose only. Readers are advised to research further to have detailed knowledge on the topic. It is very important to do your own analysis and consult your Financial Advisor before arriving at any conclusion.