Digital Banking: The Technology Driven Revolution

- Posted By Amritesh

- On July 6th, 2017

- Comments: 4 responses

Payment Banks have gained prominence of late, the regulatory body Reserve Bank of India (RBI) is encouraging such type of banks which facilitate digital transaction and simplify the process of opening savings bank account for individual transaction. It is also aimed at driving the society to cashless economy by promoting digital transaction over cash based transaction. These banks are set to revolutionize the retail banking experience.

Payment Banks facilitate smoother and hassle free platform for carrying out transaction.

Similar to Payment Banks are the Digital Banks which offer similar features to the end customers. It is very easy for the Individuals to open the account using their mobile phone and within short span of time your account is ready for transactions. In this post we would closely look at the features and benefits of such banks.

Salient Features of Payment Banks:

Payment Banks to offer Savings Account to Individuals similar to the ones offered by Traditional Banks.

Accept deposits up to Rs 1,00,000/- (maximum) from Individuals.

Extend simple Financial Products to the Individuals. (Mutual Funds, etc)

The Payment Banks are regulated by Reserve Bank Of India (RBI).

They can issue Cheques, Debit Cards to the Individuals.

These Banks cannot issue Loans and Credit Card.

Ease of transfer and remittances using the Mobile Phone.

Active Payment Banks In India

Paytm Payment Bank

Airtel Payment Bank

India Post Payments

Jio Payment Banks

Aditya Birla Payments Bank

Fino Payments Bank

Digital Banking System

Digital Banking System is also similar to Payments Bank but they offer additional facilities to the end user which makes it slightly more favourable for the end users.

Currently, digibank by DBS and Kotak811 by Kotak Bank are offering such facility.

When both the facility is compared, it appeared that digibank has more feasible facility as compared to Kotak811 and other Payment Banks.

The benefits available with digibank (In addition to benefits offered by Payment Banks):

No restriction on the Deposit from Individuals.

High Rate of Interest on Deposits.

Ease of opening the account and maintenance through Online App.

No fee on transfer of Fund or issue of Debit Card for the Individuals. DBS might also extend Credit Card facility to the Individuals in the near future.

How does Digital Banks and Payment Banks Fare?

The features and benefits offered by the Digital Banks and Payments are similar. But on close observation, one would find that Digital Banks offer additional benefits as compared to Payment Banks.

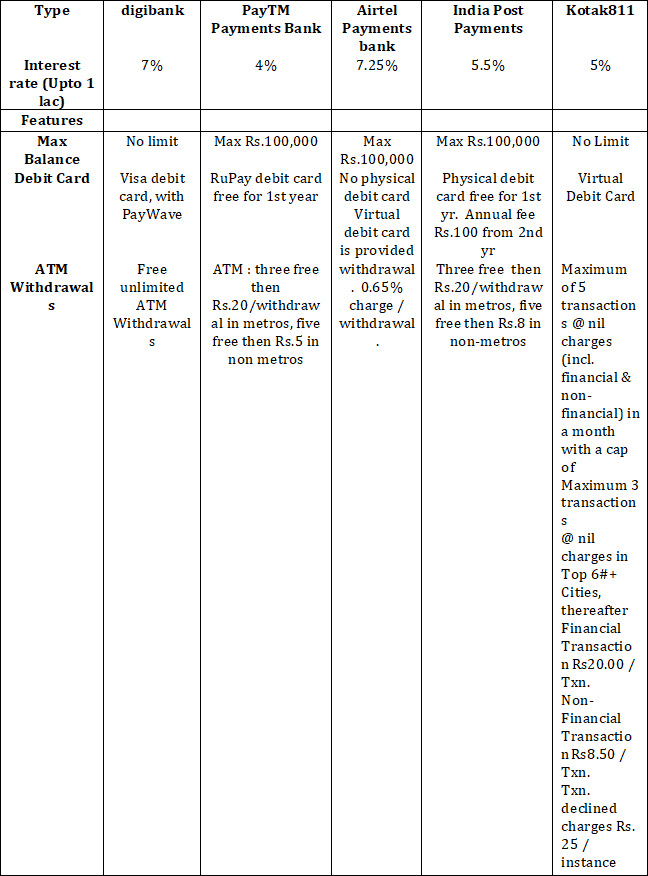

Let’s compare the features of such Banks:

Thus, as we can observe from the table, the highest interest rate is offered by Airtel Payment Bank among the existing players. However, cash withdrawal is to be charged @0.65% which does take a bit of shine away from it. Thereby, going by the benefits and features offered by digibank, it appears to provide the right balance to the end customer. You may Download digibank on the Play Store and App Store.

Note: This is a sponsored post from the respective Business House.