Professional Tax Slabs & Rates FY 2020-21

- Posted By Amritesh

- On May 8th, 2020

- Comments: one response

Professional tax (PT) is levied by the various State Governments of India on salaried individuals, working in government or non-government entities, or in practice of any profession, including Chartered Accountants, Doctors, Lawyers etc or carry out some form of business. This form of tax is in practice for a long time and States were conferred the power of leveling the Tax under Clause (2) of Article 276. The Professional tax slabs & rate is fixed based on the Income Slab of an Individual. The maximum amount of PT that may be levied by any State in a Financial Year is Rs 2500/-.

Professional Tax Slabs & Rates for the Financial Year 2021-22

Professional Tax Enrolment & Registration: All You Need To Know

The total amount of professional tax paid during the year is allowed as Deduction under the Income Tax Act. However, Individuals filing Income Tax Return under the New Tax System would have to forego deductions available on such payments.

Income Tax for Financial Year 2020-21

The professional tax is a source of revenue for the State Governments helping them in implementing various schemes for the welfare & development of the region. Recommendations have been made to revise the upper limit Professional Tax Rates as last revision was made in 1988. Professional Tax Rates for The Financial Year 2020-21 for the respective States has been discussed in this post.

Previous Year Professional Tax Rates 2019-20

Professional Tax is deducted by the employers for the salaried employees and same is deposited with the State Government. For others, they have to directly pay it to the Government or through the Local Bodies appointed to do so. The tax has to be collected and deposited as per the timeline provided by the respective State Government. In case, one fails to do so, penalty and late fee is applicable as per the Act.

Please do check out our new YouTube Channel in the link shared below & do Subscribe as it helps us remain motivated to create quality content for our viewers.

The Tax may be paid to the Government on Monthly, Semi Annually or Annually basis depending on nature of business and the respective State Laws. Professional Tax Return needs to be filed at the end of the Financial Year. For the Financial Year 2020-21, few states have made minor alteration which has been updated in this post. In case of any clarification, please get in touch with the Commercial Tax Department of the respective State.

State-wise Professional Tax Slabs & Rates Financial Year 2020-21

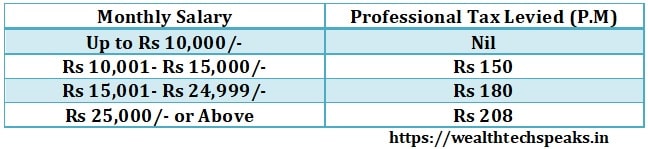

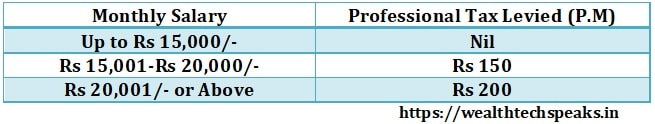

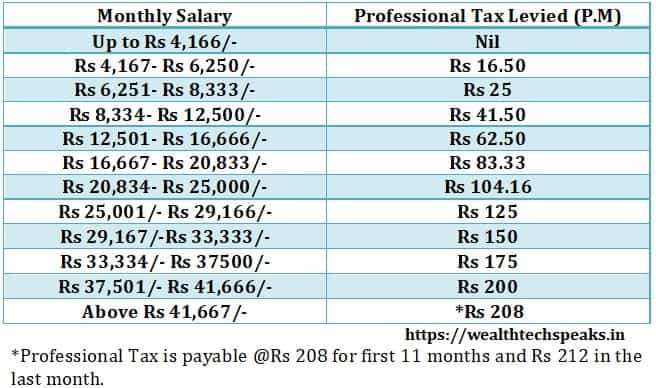

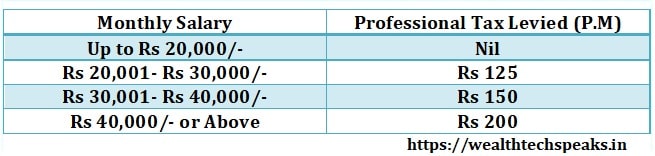

Andhra Pradesh Professional Tax

Assam Professional Tax

Bihar Professional Tax

Goa Professional Tax

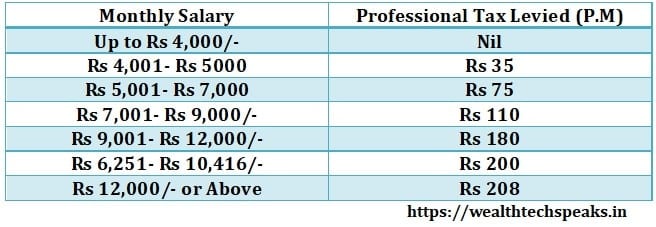

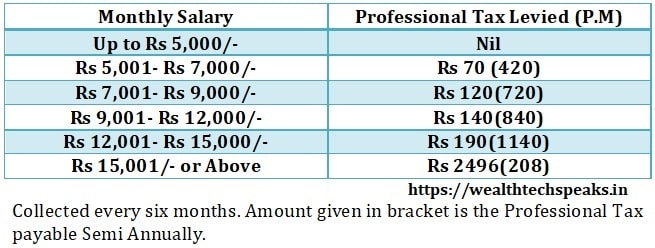

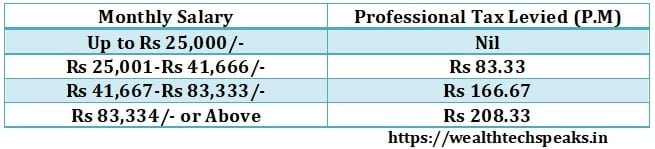

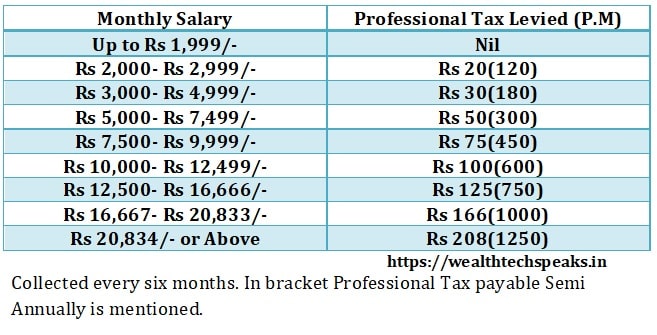

Gujarat Professional Tax

Jharkhand Professional Tax

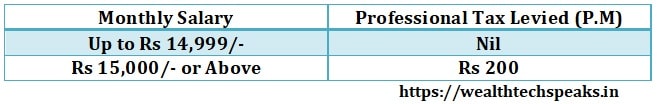

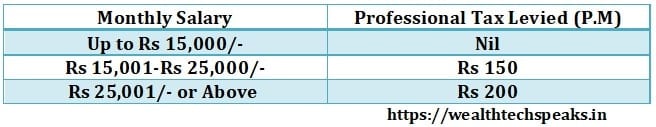

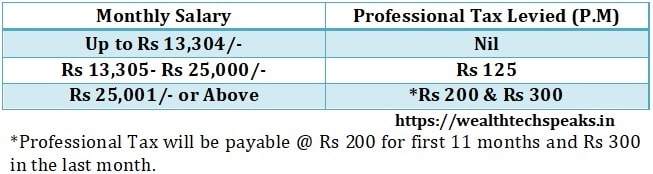

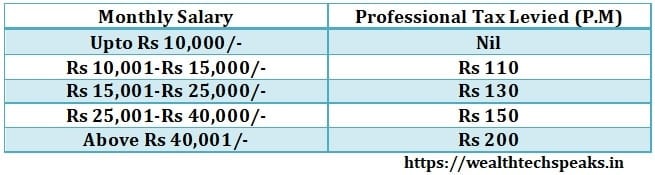

Karnataka Professional Tax

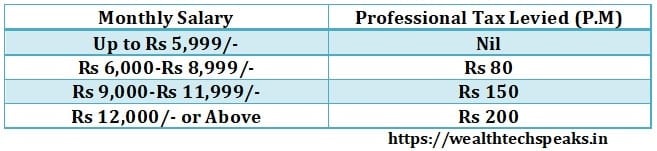

Kerala Professional Tax

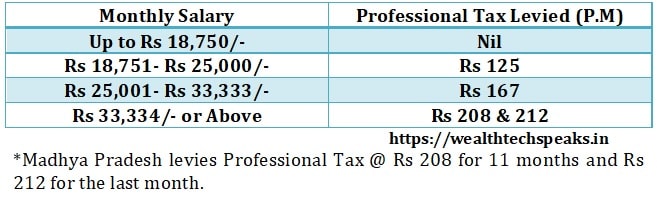

Madhya Pradesh Professional Tax

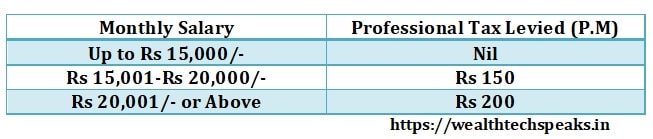

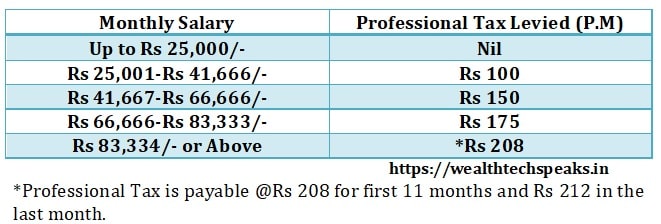

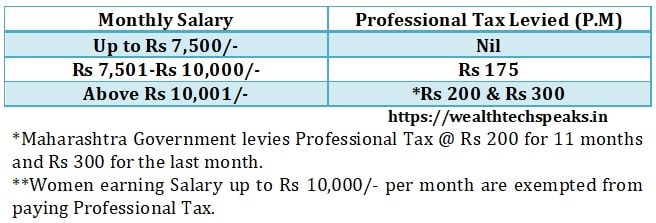

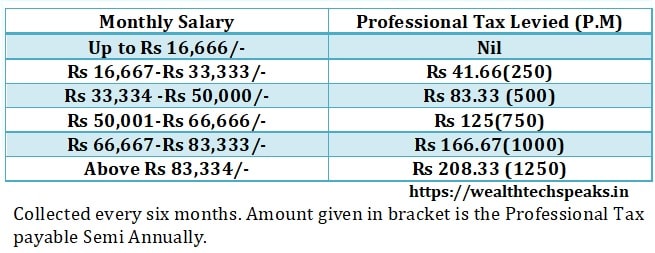

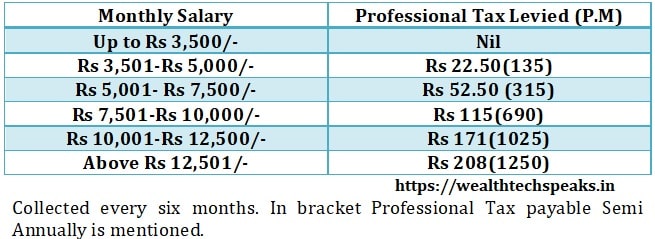

Maharashtra Professional Tax

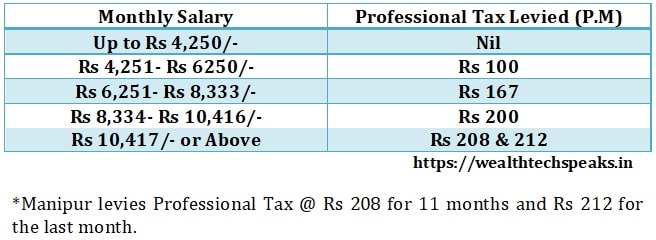

Manipur Professional Tax

Meghalaya Professional Tax

Nagaland Professional Tax

Odisha Professional Tax

Puducherry Professional Tax

Punjab Professional Tax ( State Development Tax)

Sikkim Professional Tax

Tamil Nadu Professional Tax

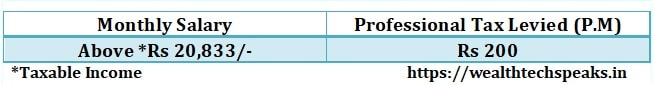

Telangana Professional Tax

Tripura Professional Tax

West Bengal Professional Tax

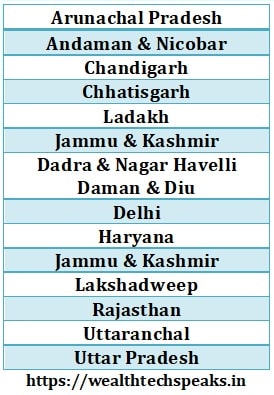

States and Union Territories : Professional Tax Slabs & Rates is Not Applicable

Some of the States do not levy or are yet to levy Professional Tax like Rajasthan, Arunachal Pradesh, Haryana, Uttar Pradesh, Uttaranchal and few more along with 7 Union Territories. Currently, 20 states and 1 Union Territory levy Professional Tax.

Note: Some Figures in Decimals may be rounded off to the nearest Rupee.

Exemption from Paying Professional Tax (As per the Act)

#Any person suffering from a permanent physical disability (including blindness) depending on provisions of PT of the respective State.

#Parents or guardian of any person who is suffering from mental retardation, if the PT Act provides provision for the same.

#Persons who have completed the age of 65 years. Subject to exemption provided by respective State. (60 years in case of Karnataka)

#Parents or guardians of a child suffering from a physical disability as specified in clause (C) w.e.f 1.10.1996, applicable as per State provisions.

Wealthtech Speaks or any of its authors are not responsible for any errors or omissions, accuracy, completeness, timeliness or for the results obtained from the use of this information. This article is for informational purpose only. Readers are advised to research further to have detailed knowledge on the topic. It is very important to do your own analysis and consult your Tax/Compliance Advisor before arriving at any conclusion.

I’m not that much of a internet reader to be honest but your sites really nice, keep it up! I’ll go ahead and bookmark your site to come back down the road. Many thanks