Income Tax Deductions Under Section 80C

- Posted By Amritesh

- On March 11th, 2021

- Comments: one response

In the Union Budget 2021, Income Tax Slabs & Rates remains unchanged. The two-tax system, New Tax regime and Old Tax regime will continue for the Financial Year 2021-22. Under the New Tax regime, Individuals enjoy the concessional tax rates but lose out on the tax deductions benefits available under the old tax regime. As many as 70 deductions & exemptions are excluded under the New Tax regime. However, Tax Deductions is still available under the Old Tax regime. Individuals can may claim tax deductions under section 80C up to the maximum limit of Rs 1.5 lacs.

Under the Old Tax regime, Individuals may reduce the tax outgo by availing the tax deductions under section 80C apart from Standard Deduction of Rs 50,000/-. Furthermore, Individuals with Taxable Income below Rs 5 lacs may claim 100% tax rebate under section 87A. Individuals with income up to Rs 7 lacs may avail tax deductions u/s 80C along with Standard Deduction to bring down their tax liability to zero.

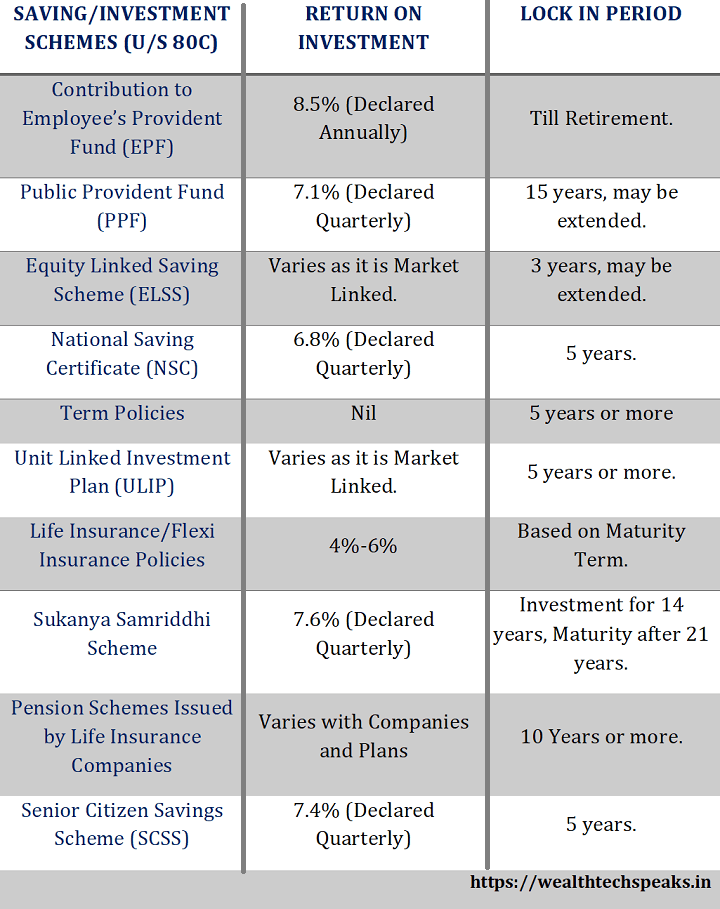

Tax Deductions U/S 80C includes contribution in tax saving Equity Linked Mutual Funds, Notified Government Savings Scheme, Life Insurance Premium, etc. Investment made to avail tax deductions U/S 80C not only reduces the tax outgo but also encourages Individual to plan for a financially secure future. Not only investment, even specified expenses is eligible for tax deduction under section 80C. Furthermore, one may claim additional Tax Deduction up to Rs 50,000/- under section 80 CCD (1b). Deduction is available on contribution to National Pension Scheme (NPS) & Atal Pension Yojana (APY), the deduction is up & over the Rs 1.5 lac deduction U/S 80C.

Notable Income Tax Deductions under Section 80C

Income Tax Deduction & Exemption up to Rs 1,50,000/- is available to Individuals under section 80C. Section 80CCC & 80CCD (1) is clubbed under Section 80C with aggregate deduction ceiling of Rs 1,50,000/-. Investment qualifying for Income Tax Deduction and Exemption under Section 80C include investment in Public Provident Fund (PPF), National Savings Certificate (NSC), Equity Linked Savings Scheme (Mutual Funds), Life Insurance, etc.

Employees’ Provident Fund (EPF): Employees’ contribution to EPF is eligible for Tax Deduction under section 80C. The contribution is deducted by the Employer from the Gross Salary and same is contributed in the Individual’s EPF account.

Public Provident Fund: One of the most popular small saving schemes among Individuals. PPF offers guaranteed return along with tax benefits. The interest is declared on quarterly basis and interest is compounded annually. The investment comes with 15-year lock-in-period.

ELSS Funds: ELSS Mutual Funds comes with shortest lock-in period of 3 years. The investment is eligible of deduction under Section 80C. The investment in Equity Mutual Funds is considered to offer better returns when compared to debt instruments. However, the investment in capital market is subject to volatility. Therefore, Investors need to take an informed decision.

National Savings Certificate (NSC): NSC comes with 5-year lock-in period. The investment is eligible for Tax Deductions. However, the interest earned is liable to Tax. The interest is revised on Quarterly basis.

Life Insurance Policies: Premiums paid towards life insurance policies is eligible for deduction under section 80C. Premium paid for Self, Spouse, Dependent Children and any member of Hindu Undivided Family is eligible for deduction. This includes Term Plans as well as Endowment Plans and Unit Linked Plans.

Income Tax Slabs & Rate for Financial Year 2021-22

Senior Citizens Savings Scheme (SCSS): The scheme is specifically for Senior Citizens and offers highest return among Small Savings Schemes. The tenure of the scheme is 5 years. Individuals above the age of 60 years is eligible to participate in the scheme.

Sukanya Samriddhi Yojana (SSY): The scheme is aimed at the welfare of a girl child. Parent or Guardian of a girl child below the age of 10 years may subscribe to the scheme. The scheme is extended to maximum of 2 girl child (3 in case of twins). The maximum deduction available is Rs 1,50,000/- under the scheme.

Tax Saving Bank Deposits: Tax Saving Term Deposits comes with 5-year lock-in period. The interest earned is taxable. However, the investment is eligible for Tax Deductions.

Contribution in Retirement Plans: Contribution up to Rs 50,000/- towards retirement plans is eligible for deduction. Deduction is up and over the deduction available U/S Section 80C. Deposits made to National Pension Scheme (NPS) and Atal Pension Yojana (APY) may be claimed as deduction.

Individuals may invest in these retirement schemes to avail tax deduction up to maximum of Rs 50,000/-.

Expenses eligible for Tax Deductions U/S 80C

Repayment of Principal on House Loan: Principal repaid is also eligible for Deduction along with Registration Fee and Stamp Duty paid towards the same. However, the benefit is restricted to the maximum deduction limit of Rs 1,50,000/-. In order to claim the deduction, Individual cannot transfer the property before expiry 5 years from the Financial Year in which it was acquired.

Registration Fee and Stamp Duty paid may also be claimed as deduction under section 80C within the limit of Rs 1.5 lac. The deduction must be claimed in the financial year when the payment is made.

Income Tax Deductions & Exemptions FY 2021-22

Payment of Tuition Fees: School fees paid by Tax Payer for their kids is eligible for tax deduction U/S 80C. Only the tuition fee among other fee components may be claimed as deduction. Fee should be paid to any school, college, university based in India.

Do subscribe to our WealthTech Speaks YouTube Channel & also our Blog as it keeps us motivated to post new content.

Wealthtech Speaks or any of its authors are not responsible for any errors or omissions, accuracy, completeness, timeliness or for the results obtained from the use of this information. This article is for informational purpose only. Readers are advised to research further to have detailed knowledge on the topic. It is very important to do your own analysis and consult your Financial Advisor before arriving at any conclusion.