Higher Pension Under Employees Pension Scheme

- Posted By Amritesh

- On April 11th, 2019

- Comments: 10 responses

Higher Pension under Employees Pension Scheme (EPS) for the EPF members is a reality now. EPF Members have finally got reason to cheer as the Honorable Supreme Court dismissed the petition filed by the EPFO seeking restraint on the verdict passed in 2018 by the Kerala High Court to provide pension to all retiring employees on full salary. Now, EPS members have the opportunity to avail higher pension provided they are willing to contribute 8.33% of full salary to the EPS Fund. Currently, Members contribution to EPS is capped At Rs 15,000/- which reduces the pension amount to the subscribers. However, if an Individual is interested in increasing the pension he/she may do so through the employer by sending an application to the EPFO requesting for revision in the contribution pattern to EPS Fund.

However, Subscribers interested in availing higher pension will have to let go significant amount of their respective EPF corpus. Member of EPS is eligible for pension on successfully contributing to EPS Fund for 10 years and on completion of 58 years of age. Pension before the age of 58 is also possible but at reduced rate. Please refer to the links shared below for complete details.

All You Need To Know About EPS

Pension Calculation Under EPS

Benefits Under EPS

Increase Pension: EPS Deferred Withdrawal

An amendment in March 1996 to EPS Act allowed Subscribers to contribute @ 8.33% on the full salary, provided Employee and the respective Employer agree to do so.

Note: Clarification regarding the striking down of August 2014 circular along with other implications of the verdict is awaited from EPFO, as it bears significant ramifications for the Employees. This post shares possible impact of the Court ruling on EPS. Readers are requested to wait till the contentious points are clarified by the EPFO.

Key Points Related to Higher Pension under Employees Pension Scheme (EPS)

#Members allowed to contribute to the EPS Fund on the full salary.

#Pensionable Salary may be determined on the basis of last 12 months Salary instead of 60 months.

#Individuals joining service on or after 1st September, 2014 eligible to contribute to the EPS Fund.

#Subscribers interested for higher pension amount may be required to adjust their respective EPF Balance with EPS Fund.

#Pension provided on full salary for members opting for higher contribution to EPF Fund.

Employees Pension Scheme (EPS), 1995

EPS is applicable to Employees covered under the Employees’ Provident Fund (EPF). EPS was introduced in 1995 to provide pension benefit to EPF subscribers replacing the Family Pension Scheme 1971. Employees working in private sectors are covered under EPS.

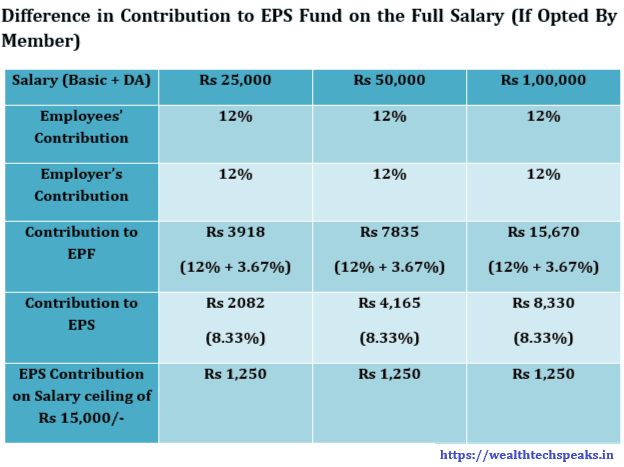

Employer as well as the Employee contributes @ 12% of the Salary each to the EPF, out of which employer’s contribution of 8.33% is diverted to EPS fund. The contribution is calculated on the Basic salary (Basic plus Dearness Allowance) of the employee. The contribution to EPS is capped at Rs 15,000/- of the salary, previously till August,’14 the limit was set @ Rs 6,500/- and till May, 2001 the contribution was limited to Rs 5,000/-.

However, the recent ruling allows Subscribers to contribute 8.33% of the full salary to EPS, enabling them to receive higher pension benefit. Even Subscribers joining service post August, 2014 is eligible for the higher pension benefit under EPS.

As per the August 2014 circular, Employees joining service on or after 1st September, 2014 with salary above Rs 15,000/- do not contribute to EPS.

An employee is eligible for pension on attaining 58 years of service and has contributed to EPS Fund for at least 10 years.

Supreme Court Verdict on Higher Pension under Employees Pension Scheme (EPS)

Supreme Court on 1st April,’19 upheld judgment passed by the Kerala High Court, as it dismissed a special leave petition filed by EPFO seeking to cap the contribution limit to Rs 15,000/-. The August, 2014 circular restricting the Contribution to EPS @ Rs 15,000/- is to be set aside. Also, Pensionable Salary is to be calculated as per the average salary of last 12 months instead of 60 month salary as notified in the circular.

Furthermore, Members joining service post the notification will also eligible to contribute to the EPS Fund.

Supreme Court in October, 2016, ruled that EPFO is required to provide higher pension to Subscribers who had availed the option. Furthermore, Subscribers interested in availing the higher pension option may do so by making lump sum deposits (gap between contributions made and required to be eligible for the benefit).

Contribution of the Members

As stated earlier, Members contribute @8.33% of the Employer’s contribution to the EPS Fund, the same is currently capped at maximum salary @ Rs15,000/- per month. Thus, Members contribute maximum of Rs 1,250 to the EPS fund as per the existing norms. However, as per the ruling Members may be able to contribute @8.33% of the full salary (Basic plus DA). This would enable Members to receive higher pension benefit.

This would also mean the EPF accumulation being significantly reduced as higher amount gets diverted to the EPS Fund.

Retrospective Calculation for Higher Pension under Employees Pension Scheme (EPS)

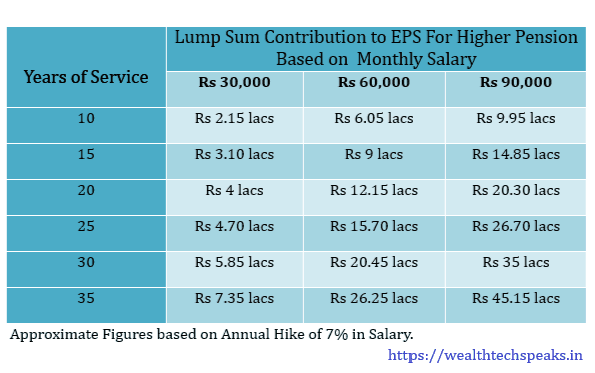

Members who have not contributed to EPS Fund on full salary, but would like to avail the higher pension benefit may do so by paying the difference amount as lump sum or by adjusting the existing EPF Balance. (Clarification from EPFO is awaited on the same)

EPS Members willing to receive higher pension will have to divert substantial amount to the EPS Fund. As per approximation, an Employee contributing to EPF at maximum wage ceiling for past 20 years would be required to make additional contribution of Rs 4 lacs and forego interest earned on it to the tune of Rs 8 lacs, if the monthly salary is around Rs 60,000.

Retrospective Calculation is applicable for Members nearing their retirement. Even Members who have retired may be able to avail the benefit on deposit of the difference amount. Calculation is done for an Individual attaining 58 years of age.

Calculation of Higher Pension under Employees Pension Scheme (EPS)

Well, how do these changes affect the EPS Members?

Let’s find out…. (Approximate Figures)

Last Drawn Salary: Rs 50,000/-

Average Salary for last 12 months: Rs 50,000/-

Total Pensionable Years of Service: 20 years

Pensionable Service: In case of Pensionable Service Years being more than 20 years, 2 years additional weightage is given.

Pensionable Salary Is Divided By 70: As per the Central Government Service Pension Scheme; pension benefit for Individuals with 33 years or more service is 50% of the salary. Under EPS-95, Individual with 33 years of service is eligible for 2 years additional bonus. Accordingly, 35 years of service needs to be divided by 70 to provide 50% of the salary as pension.

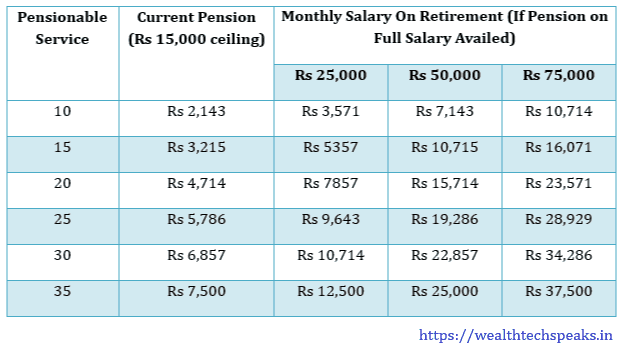

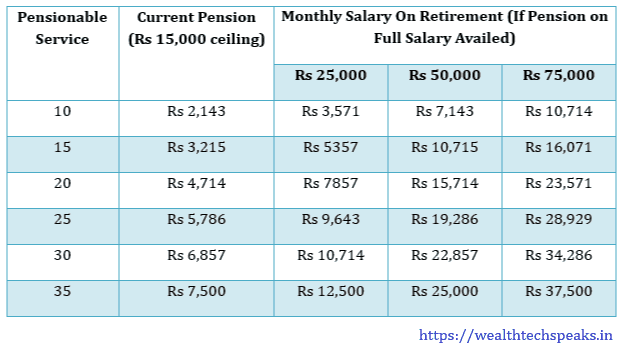

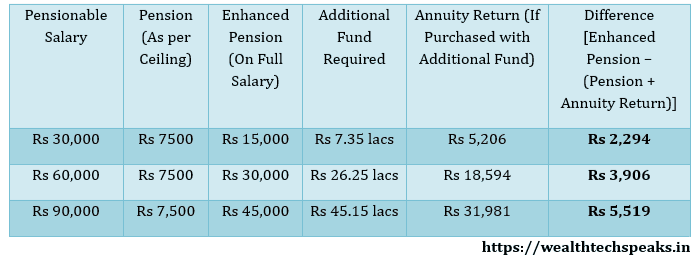

Higher Pension under Employees Pension Scheme (EPS) is possible for the Subscribers if contribution is made on the full salary. Subscribers opting for contribution to EPS on full salary stand to gain at least 66% hike on current pension level. The figure stands to increase as high as 500% for Individuals with monthly Salary of Rs 75,000/-. Thus high salaried Individual will benefit from the latest ruling in terms of pension.

Should EPS Members opt for Higher Pension?

EPS Members should keep following things in mind while opting for Higher Pension;

#Pension received is taxable as per the existing Tax Slab.

#No lump sum benefit is admissible in lieu of the Pension paid to the member.

#Higher contribution to EPS will reduce the retirement accumulation under EPF.

#EPS Pension remains fixed and highly unlikely to rise. (Provided the pension is on full salary)

#EPS Pension is received by the Spouse on death of the Member, the amount is reduced by 50%.

EPS higher pension is available to the Members but they have to contribute considerable amount from EPF corpus to EPS fund. This implies that EPF corpus will be greatly reduced at the time of retirement for Members. Thus Individuals need to decide between higher EPF corpus or higher pension. The negative side of opting for higher pension is that the contribution to EPS cannot be withdrawn as lumpsum. However, the Pension offered on the full salary is comparatively higher to annuity plans which provide regular income to the Individual.

Therefore, in case an Individual has got substantial savings (accumulated funds) to take care of any financial obligation arising in future (e.g health care, other critical needs, etc). It is advisable to opt for higher pension under EPS as the returns is better when compared to Annuity Plans and interest on Fixed Deposits.

Comparison

Individuals with good knowledge and expertise in managing their Funds may be able to generate better returns by investing in high yield Bonds and Systematic Withdrawal Plans (SWP).

This article is for informational purpose only. Readers are advised to research further to have detailed knowledge on the topic. It is very important to do your own analysis and consult your Financial Advisor before arriving at any conclusion.The article attempts to provide insight on latest ruling on EPS. However, in case some information is missed or needs revision, please feel free to update on the same.