Instant e-PAN Online For Individuals

- Posted By Amritesh

- On July 10th, 2018

- Comments: one response

Income Tax Department (IDT) has launched facility to apply for instant e-PAN online for Individuals with valid Aadhaar ID, free of cost, for limited time period. This step is taken to facilitate the income tax return filing process, the last date for return filing is 31st July, 2018. The facility is provided for free and e-PAN (Permanent Account Number) is allotted in shortest possible time to the Individual.

Currently, the Instant e-PAN facility (Beta Version) is closed as of 06.07.2018. However, the facility is expected to be made available at a later date.

Income Tax Return (ITR Forms): Assessment Year 2018-19

e-PAN card is digitally signed electronic version of the conventional PAN Card issued by the Income Tax Department using the Aadhaar e-KYC. The mobile number linked with Aadhaar should be active to complete the verification process.

IT Department will not issue physical PAN cards to the e-PAN holders. Individuals may download the e-PAN from Income Tax e-filing portal. E-PAN is equivalent to PAN card, so Individuals may continue using the e-PAN.

Applicability/Eligibility

Individuals not having a PAN Card can only apply for e-PAN.

Only Resident Individuals with valid Aadhaar ID may apply for the PAN Card. Minors, Persons covered u/s 160 of the Income Tax Act, Hindu United Family (HUF’s), Firms, Trusts, Companies, etc are not eligible to apply.

Individuals should ensure that the information provided in the Aadhaar ID is correct to complete the application process.

Online Application for Instant e-PAN Online

Applying for e-PAN is very simple and easy. The entire process is to be completed digitally, no paper work is involved.

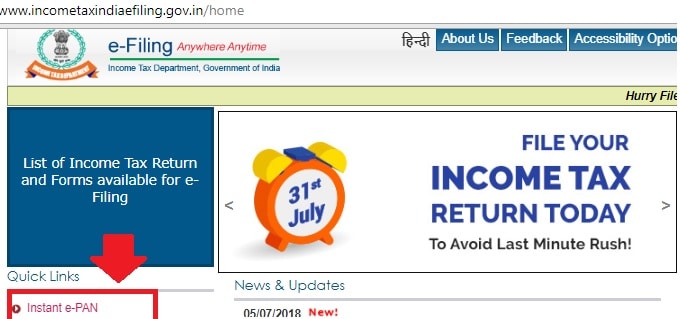

Any Individual interested in applying for e-PAN may log on to the Income Tax e-filing portal and fill up the required details as provided in the Aadhaar.

Scanned Image of Signature needs to be uploaded (Resolution 200 dpi, JPEG, File Size up to 10Kb, dimension 2cm*4.5 cm)

OTP (One Time Password) will be sent to the registered mobile number to complete the authentication process.

On successful e-filing of e-PAN application, 15 digit acknowledgement number will be generated and sent to the registered mobile number/email id of the applicant.

Allotment of Instant e-PAN Online

On successful e-PAN allotment, the applicant will receive the notification via sms/email. Accordingly, Individual may download the e-PAN from the Income Tax e-filing portal, by providing the acknowledgement number, shared at the time of successfully filing the e-PAN application.

Individual applying for e-PAN should make sure that Aadhaar credentials is correct and there is no mismatch with the details provided in the application.

This article is for informational purpose only. Readers are advised to research further to have more clarity on the topic. It is very important to do your own study and consult your Financial/Tax Advisor for complete information.

levitra 10 mg basf They have longer half lives and higher energy gamma emissions, or in the case of 201 Tl, also emit Auger electrons and therefore lead to an increase in the radiation dose even for smaller injected dosages