Marginal Relief on Surcharge: Income Tax

- Posted By Amritesh

- On June 22nd, 2018

- Comments: 2 responses

Income Tax is levied on the basis of the income slab an Individual falls under and the tax rate fixed for the same. The maximum tax rate on Individual income currently levied is 30% plus Health & Education Cess of 4%. Income Tax Surcharge of 10% is levied if the income exceeds 50 lakhs, whereas income above 1 crore attracts 15% surcharge on the Tax payable. Marginal Relief on Surcharge is applicable, provided the incremental income tax (including surcharge) is more than the incremental income (above Rs 50 lakhs or Rs 1 crore, as the case may be).

As per Concept of Marginal Relief, if the amount payable as surcharge exceeds the income above Rs 50 lakhs or Rs 1 crore (as the case may be), the surcharge will be applicable at marginal rate, implying 70% of the incremental income above 50 lakhs or 1 crore (as applicable) is taken into consideration.

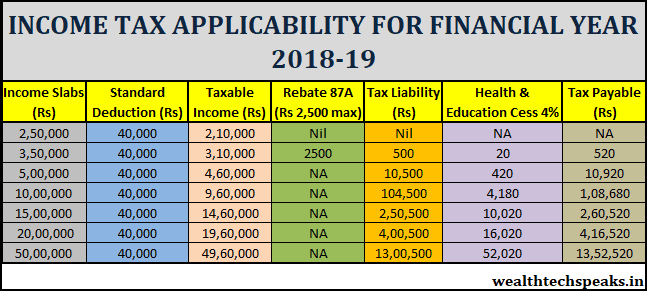

Income Tax For Financial Year 2018-19: Slabs and Deductions Available

Applicability of Marginal Relief on Surcharge

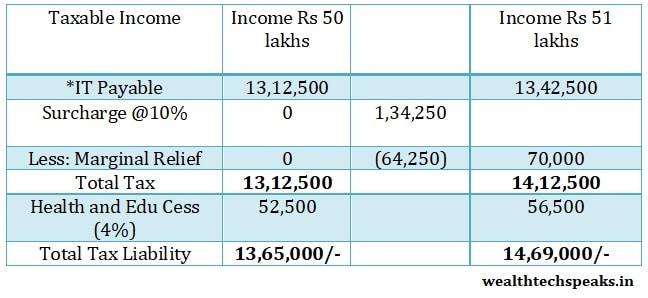

In case Income Marginally Exceeds Rs 50 lakhs

If, Individual’s taxable income is Rs 51 lakhs, implying that the tax liability amounts to Rs 13,42,500/- excluding the cess and surcharge. Now, Surcharge @10% would amount to Rs 1,34,250/-, thus the overall tax liability rises to Rs 15,35,820/- inclusive of Surcharge and Cess (4%).

Difference in Tax when income is Rs 51 lakhs and Rs 50 lakhs;

Increase in Income Tax (excluding Cess): Rs 14,76,750/- minus Rs 13,12,500= Rs 1,64,500/-.

Marginal Relief = Increase in Tax – Marginal Income Above 50 lakhs

= Rs 1,64,500 – Rs 1,00,000 = Rs 64,500/-

Applicability of Marginal Relief, since the incremental Income is marginally above Rs 50 lakhs and increase in tax liability exceeds such incremental income, Marginal Relief will be applicable and 10% Surcharge would not be levied. In this case, Surcharge will be applicable at Marginal Rate, i.e, 70% above the incremental income exceeding Rs 50 lakhs, (51-50)= Rs 1 lakh. Surcharge applicable is 70% of Rs 1,00,000= Rs 70,000/-.

Hence, the Tax Liability after Marginal Relief will be Rs 14,69,000/- (including surcharge and cess).

Calculation of Tax Liability-Under Marginal Relief

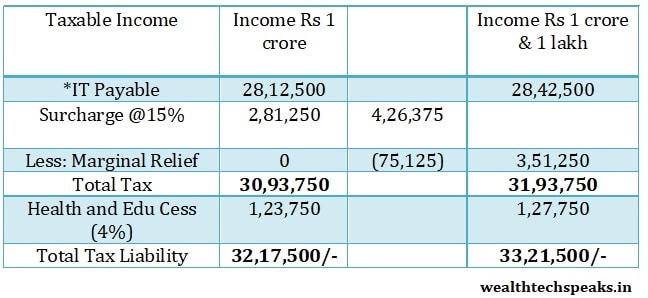

In case Income Marginally Exceeds Rs 1 crore

If, Individual’s taxable income is Rs 1.01 crore, implying that the tax liability amounts to Rs 28,42,500/- excluding the surcharge and cess. Now, Surcharge @15% would amount to Rs 4,26,375/-, thus the overall tax liability rises to Rs 33,99,630/- inclusive of Surcharge and Cess (4%).

Difference in Tax when income is Rs 1 crore and Rs 1 crore & 1 lakh;

Increase in Income Tax (excluding Cess): Rs 32,68,875/- minus Rs 30,93,750= Rs 1,75,125/-.

Marginal Relief = Increase in Tax – Marginal Income Above 1 crore

= Rs 1,75,125 – Rs 1,00,000 = Rs 75,125/-

Applicability of Marginal Relief, since the incremental Income is marginally above Rs 1 crore and increase in tax liability exceeds such incremental income, Marginal Relief will be applicable and 15% Surcharge would not be levied. In this case, Surcharge will be applicable at Marginal Rate, i.e, 70% above the incremental income exceeding Rs 1 Crore, (1.01-1)= Rs 1 lakh. Surcharge applicable is 70% of Rs 1,00,000= Rs 70,000/-.

a.) Surcharge @15%= Rs 4,26,375/-

b.) Surcharge @10% (upto 1 crore)= Rs 2,81,250/-

Marginal Relief= Additional Surcharge minus Surcharge Applicable

Rs 1,45,125 – Rs 70,000 = Rs 75,125/-

Hence, the Tax Liability after Marginal Relief will be Rs 33,21,500/- (including surcharge and cess).

Calculation of Tax Liability- Under Marginal Relief

Marginal Relief on Surcharge provides relief to the Individuals whose income marginally exceeds the threshold limit set for levy of surcharge.

This article is for informational purpose only, aiming to provide brief idea about Relief on Income Tax Surcharge and its applicability. Readers are advised to research further to have more clarity on the topic. We do not claim expertise on the subject. It is very important to do your own study and consult your Tax Consultant before making any income tax related decision.