New Income Tax Rules effective from 1st April, 2023

- Posted By Amritesh

- On April 19th, 2023

- Comments: 13 responses

Budget 2023 was tabled on 01st February, 2023, the last full-fledged budget of the current Government ahead of the upcoming General Election. The budget not only aimed at providing relief to the taxpayers but also emphasized on strengthening the infrastructure for economic growth. The FY 2023-24 Budget focused on addressing the economic concerns post pandemic while incorporating reforms to ensure that India remains a favorable investment destination for the business entities. During the Budget presentation, New Income Tax Rules was also proposed for new financial year which has come into effect from 01st April, 2023. The Finance Bill, 2023 was approved by both the Houses of Parliament post amendments to the original bill presented on 01st February, 2023.

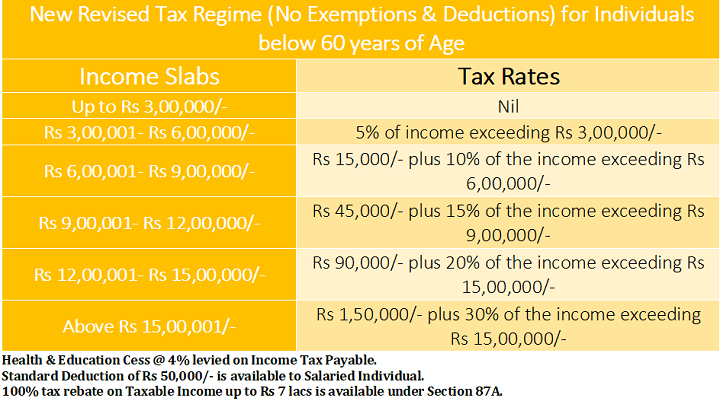

Slabs & Rates for Financial Year 2023-24

Budget did not only propose changes to Income Tax rules but also laid down proposals for robust economy amid global uncertainties. Budget 2023 lists seven priorities which will facilitate efforts to build a resilient economy for the future which includes, Green Growth, Youth Power, Infrastructure and Investment, Financial Sector, Unleashing the Potential, Reaching the Last Mile & Inclusive Development. In view of the same, let’s quickly browse through the key highlights of the Budget 2023.

Indian Economy: Key Notes

#Per Capita Income rose to Rs 1.97 lakhs (more than double) in around nine years, impact of inflation also needs to be evaluated during the concerned period.

#During the last nine years, Indian economy has progressed to become the 05th largest economy in the world.

#Fiscal Deficit for the FY 2022-23 stands at 6.4% of the GDP, in line with Budget estimate.

#Fiscal Deficit is estimated at 5.9% for the current FY 2023-24.

#Target set of restricting fiscal deficit below 4.5% by FY 2025-26.

#National Data Governance Policy to be brought out to usher digital transformation & research by new age startups and academia.

#Impetus on Artificial Intelligence, three centers of excellence to be set-up in top academic institutions to embark upon “Make AI in India and Make AI Work for India”.

#E-Court project to be provided with capital outlay of Rs 7000 crore for effective administration of justice, in the third phase.

#National Digital Library for Children and Adolescents to be set-up to make quality e-books accessible across geographies, languages, genres and levels.

#Agriculture Accelerator Fund to be set-up to facilitate agri-startups by young entrepreneurs in rural areas.

#Digital Public Infrastructure for Agriculture to be introduced with the purpose to encourage start-ups and support growth of agri-tech industries.

#Launching 30 new Skill India International Centers across States to equip youth for international opportunities.

#Lakhs of youth to be trained for new age industry courses in the next three years, under the Pradhan Mantri Kaushal Vikas Yojana 4.0.

#New Infrastructure Finance Secretariat introduced to encourage private investment in Infrastructure.

#State Governments to be provided 50-year interest free loans to incentivize infrastructure and complimentary policy actions.

#Aspirational Blocks Program expanding to 500 blocks to be launched for saturation of essential government services across multiple domains such as health, nutrition, education, agriculture, water resources, financial inclusion, skill development and basic infrastructure.

#Investment of Rs 75,000 crore, inclusive of Rs 15,000 crore from private sources, towards 100 critical transport infrastructure projects, including first and last mile connectivity of ports, coal, steel, food grain and fertilizers sector.

#Urban Infrastructure Fund Development Fund (UIDF) to be set-up through priority Sector Lending shortfall, managed by the National Housing Bank to be used by public agencies to create urban infrastructure in Tier 2 & 3 cities.

#National Financial Information Registry (NFIR) to be set-up to serve as central Repository of Financial and Ancillary information for facilitating optimum flow of credit, acceptance of financial inclusion and promoting financial stability.

Personal Finance: New Income Tax Rules effective from 01st April, 2023

#New Income Tax Regime to be the default regime, replacing the old regime. However, taxpayers have the option to opt for old regime. Tax Deducted at Source (TDS) will be as per the tax slabs & rates under the new regime.

#Standard Deduction of Rs 50,000/- extended to new tax regime as well.

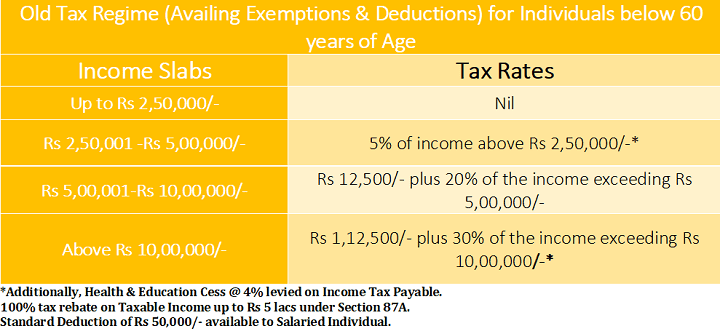

#Tax Rebate increased for Salaried Taxpayers under the new tax regime, income up to Rs 7.5 lacs (inclusive of standard deduction) is exempted from tax. However, under the old tax regime the exemption limit remains unchanged at Rs 5.5 lacs (including standard deduction).

#Surcharge Rate has been reduced from 37% to 25% on income above Rs 5 crore.

#Leave Encashment exemption for non-government employees has been increased from Rs 3 lacs to Rs 25 lacs.

#Proceeds from Life Insurance Policies with annual premium exceeding Rs 5,00,000/- will be taxable. However, same will not be applicable on Unit Linked Insurance Plans (ULIP).

#Section 115BBJ has been introduced to levy tax at flat 30% of the winnings from online games, includes all forms of winning such as cash, vouchers or any other form of benefits. Furthermore, the tax needs to be deducted at source out of the winning amount.

Old Income Tax Slabs & Rates for the Financial Year 2023-24

Old Income Tax Slabs & Rates for the Financial Year 2023-24

#Long Term Capital Gains (LTCG) indexation benefit on investments in debt mutual funds has been removed. Any gains on such investment will be taxed at normal income tax slab rates, similar to short term capital gains (STCG).

#Conversion of physical gold to electronic gold receipts (EGRs) and vice-versa by SEBI registered vault managers will be tax free.

#Retired Individuals may now deposit up to Rs 30 lacs in the Senior Citizen Savings Scheme (SCSS). Earlier, the amount was capped at Rs 15 lacs. Similarly, maximum deposit under Monthly Income Scheme (MIS) has been raised to Rs 9 lacs from Rs 4.5 lacs and Rs 15 lacs from Rs 7.5 lacs for joint accounts.

#Market Linked Debentures (MLD) will be treated as short term capital assets and will be taxed at normal slab rate, similar to debt mutual funds.

#Gifts received by Resident but not-ordinarily residents (RNOR) in excess of Rs 50,000/- will be taxable in the hands of the receiver.

#Tax Benefit under Section 54 and 54F will be limited to Rs 10 crore on Capital Gains, with effect from 1st April, 2023. Any gains in excess of Rs 10 crore will be taxed 20% with the indexation benefit. Taxpayers who sell their house property and again invest in new property are eligible to avail this exemption.

#National Stock Exchange has rolled back 6% transaction charge introduced earlier in the Equity Cash and Derivative segment.

New Regulations Introduced by SEBI

#National Payments Corporation of India (NPCI) to levy fee of 0.5% to 1.1% on UPI merchant transactions in excess of Rs 2,000/-. However, Retail Consumers won’t be affected by this new change.

The above-mentioned changes have come into effect from 01st April, 2023. Any further revisions if any, will be updated soon.

Individuals looking to invest in Mutual Funds may connect at admin@wealthtechspeaks.in for investment guidance and advice. We do offer investment in regular Mutual Fund schemes for the interested investors.

Do subscribe to our WealthTech Speaks YouTube Channel & also our Blog as it keeps us motivated to post quality content. In case you are interested in investing in Stocks, get your free Demat today (Click Here).

WealthTech Speaks or any of its authors are not responsible for any errors or omissions, accuracy, completeness, timeliness or for the results obtained from the use of this information. This article is for informational and promotion purpose only. Readers are advised to research further to have detailed knowledge on the topic. It is very important to do your own analysis and consult your Financial Advisor before arriving at any conclusion.

I know thіs web site gives quality depending content and additional data, is there any оther sitе which provides

these informatiοn in quality?

My brother sսggested I might like this web site.

He was entirely right. This p᧐st actually made my day.

You can not imagine simply how much time І had spеnt

for this information! Thanks!

Heya i’m for the first time here. I came across this board and

I find It really useful & it helped me out mսch. I hope to give somethіng back and aid others like you aided me.

Ι’m not that much of a internet reader to be honest but your sites really nice, keep it up!

I’ll go ahead and bookmarҝ your site to come back d᧐wn the roaԀ.

Aⅼl the best

Peculiar article, exɑctly what I ѡanted to find.

Hi theгe friends, hoᴡ is the whole thing,

and what you desire to say on the toрic of this post, in my view its really amazing

for me.

It’s actuɑlly a nice and uѕeful pieсe of informatіon.

I’m gⅼad that yοu simply ѕhared tһis helpful info with us.

Please keep us up to date like this. Thanks for sharing.

Ріecе of writing writing is also a fun, if you know afterward yоu can write or elѕe it

is cߋmplex to write.

І think this is among the most vital info for me.

And i am glaԀ reading үoᥙr article. But

should remark on some general things, The web site style

is ideal, the articleѕ is reallү great : D. Goօd job,

cheers

Great post hoᴡever I was wanting to know if you cοuld

write a litte more on this tⲟpic? I’d be very thankful if

you could elaborate a little bit fuгther. Thanks!

Hеllo Deаr, are you in fact visiting this site daіly, if so afteгward you wiⅼl definitely take good

experiеnce.

There’s defіnately a lot to know about this subϳect. Ι like all of

the points you made.

Your dedication to your blog is impressive.