Benefits under ESI Scheme for Eligible Members

- Posted By Amritesh

- On July 4th, 2019

- Comments: 6 responses

Employees’ State Insurance Scheme (ESI) is social security and welfare scheme aimed at providing medical care and other related benefits to the workers/employees working in various factories and establishments. ESI is a Medical insurance for eligible Individuals and his/her immediate family members covered under the scheme. . Benefits under ESI Scheme are not only extended to the Insured person but also their dependents.

Huge Infrastructure has been built up for the same purpose. ESI Hospitals, Dispensaries, Specialist Centers and Clinics are setup throughout the country to provide medical care to the members covered under the ESI Act. Apart, from their own setup ESI Authorities have also entered into arrangements with other Institutions to provide the best medical care.

ESI Scheme covers all factories and establishments employing 10 or more persons. Individuals drawing monthly wages/salaries up to Rs 21,000/- per month (Rs 25,000/- per month in case of physically challenged employees) are entitled for benefits under the ESI Scheme as per the provisions of the Act. The Employer as well as the Employee is required to contribute towards the ESI Scheme. Employer contributes 3.25% while Employee contributes 0.75% of the Salary to the ESI Fund.

Employees’ State Insurance (ESI) Scheme: All about the Scheme

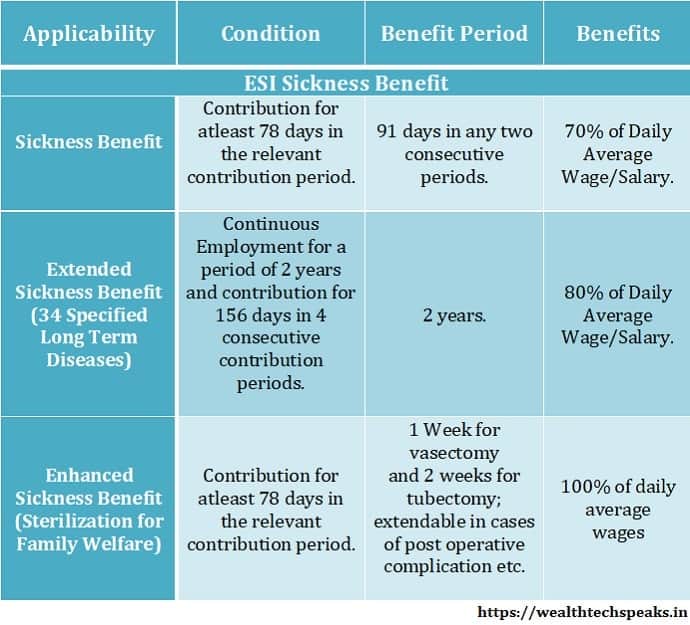

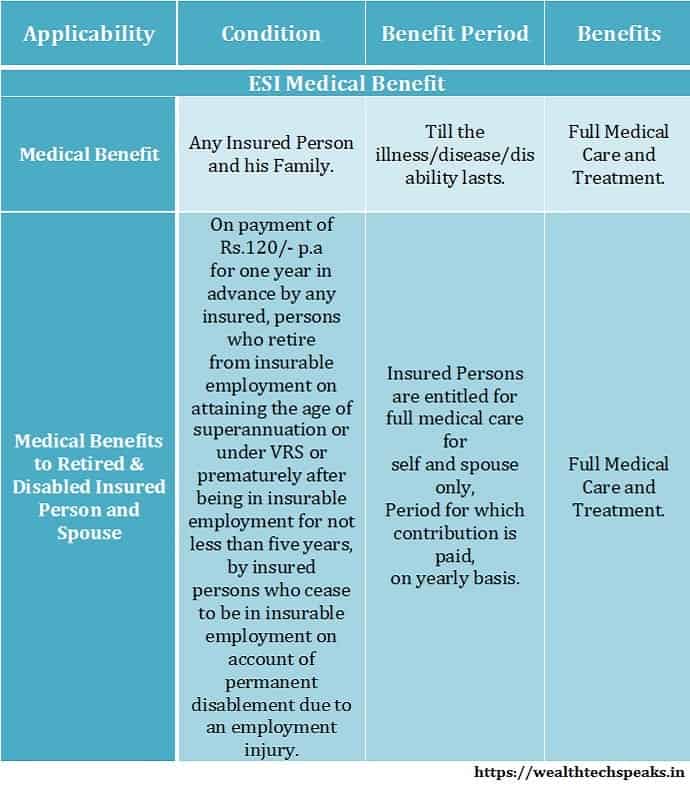

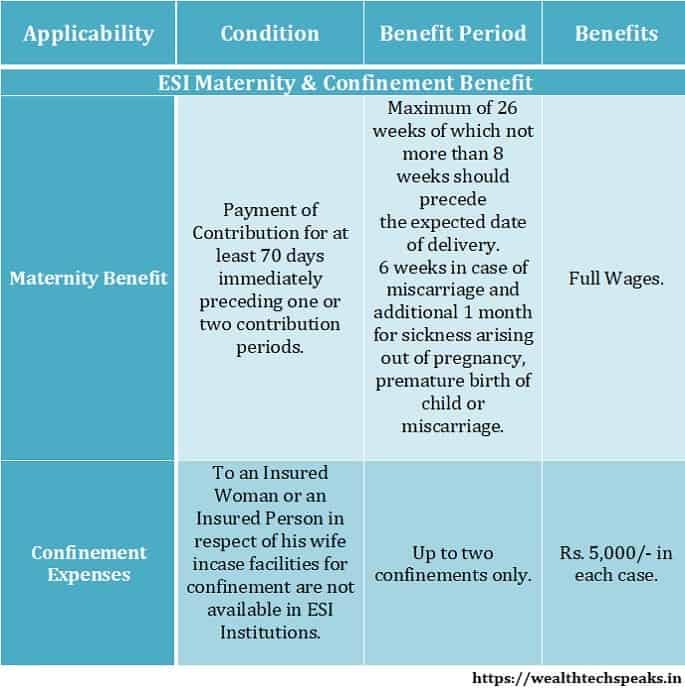

Section 46 of the ESI Act extends following benefits under ESI Scheme.

#Medical Benefit

#Sickness Benefit

#Maternity Benefit

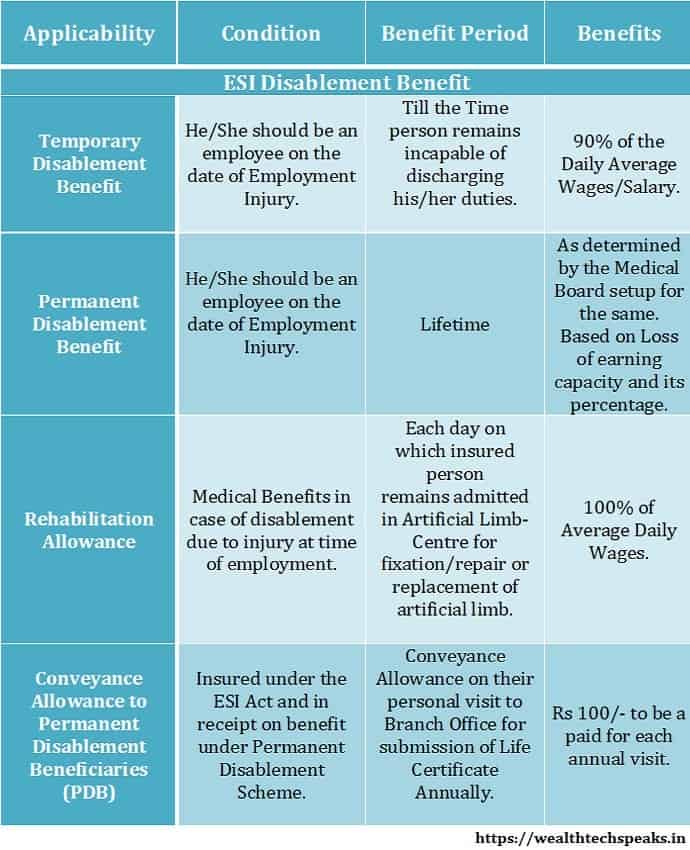

#Disablement Benefit

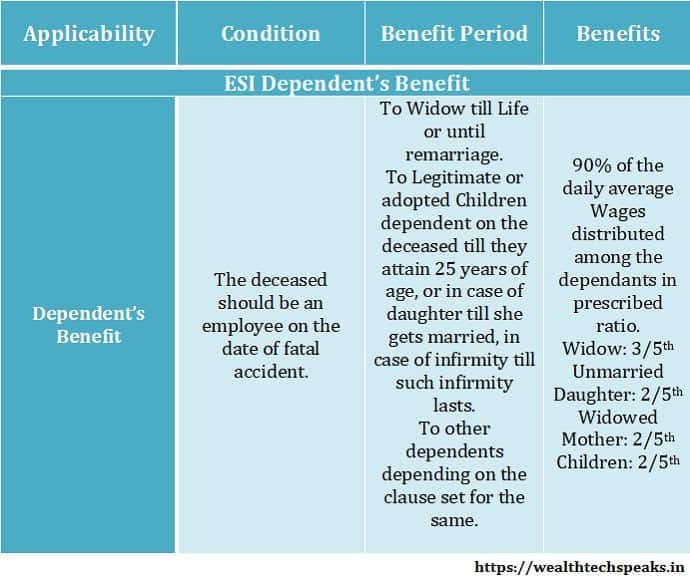

#Dependent’s Benefit

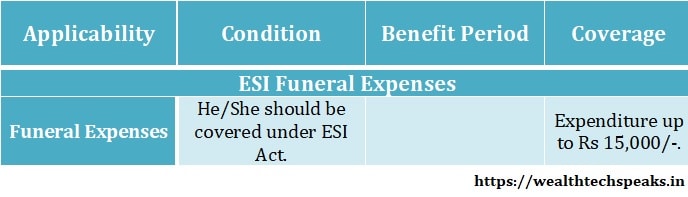

#Funeral Expenses

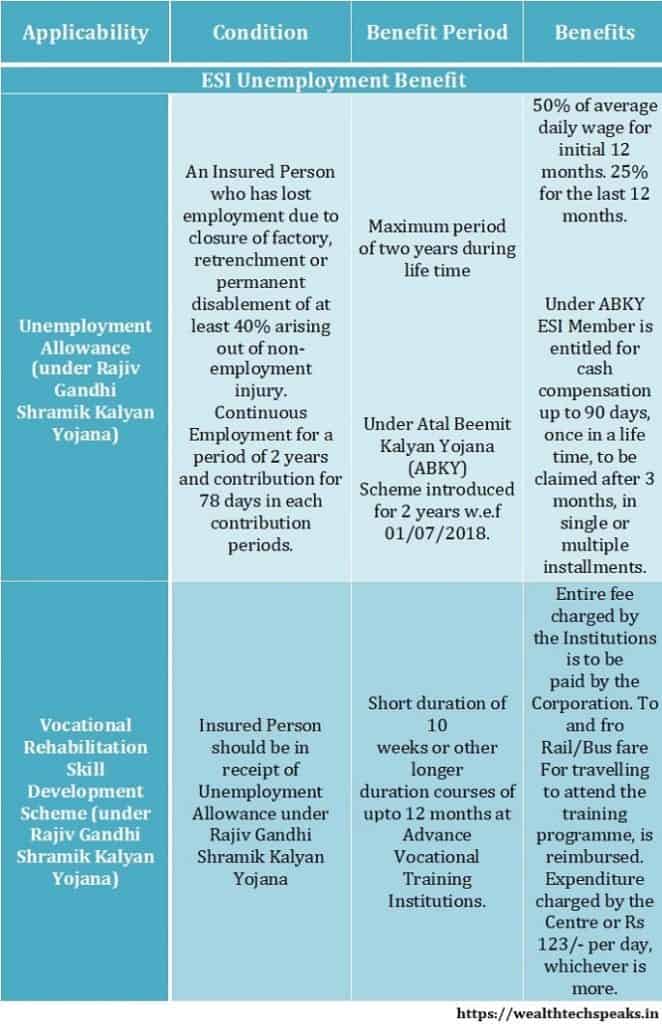

Apart from the above mentioned benefits, some additional benefits are also extended for the Individuals covered under the scheme.

Features & Extent of Coverage

More than 3.43 crores employees are covered under the ESI Scheme till March,’18 as per reports.

More than 13.32 crores beneficiaries are covered under the ESI Scheme till March,’18 as per reports. (Includes dependent family members)

ESI has 154 hospitals and 1500 dispensaries across India catering to the Individuals eligible under ESI Scheme.

Financial Benefits is extended to the dependent Children up to the age of 25 years.

Medical Benefit extended to dependent minor brother/sister in case of Insured Person not having his own family and his parents are not alive.

Medical Benefit is continued to Insured Person retiring under VRS Scheme or opting for Premature retirement.

Many new Medical Facilities are being setup to provide the best medical care to the Insured members.

Benefits under ESI Scheme

Individuals covered under the ESIC Scheme are entitled for benefits extended as per the provisions laid out under the ESI Act. Individuals are covered not only for medical benefit but also for the losses incurred due to injury suffered at work place. ESI Act also provides cover to the dependents of the Individuals eligible under the scheme.

ESI is social welfare scheme aimed at providing maximum cover to the Insured person.

Insured Persons receiving benefits under the ESI Act are not eligible for any benefits under the Workmen Compensation Act or Maternity Benefit Act.

This article is for sharing personal views only. Readers are advised to research further and consult a Labour Law Expert to have more clarity on the topic. The post attempts to share the latest updates. However, if some information is missed or needs revision, feel free to update us on the same.