National Pension Scheme (NPS) : All Citizen Model

- Posted By Amritesh

- On February 12th, 2019

- Comments: 7 responses

National Pension Scheme (NPS) was introduced by the Government of India in 2004. NPS is aimed at the providing financial security to the Subscribers post retirement. Initially, NPS was available only for the Government Employees. However, in 2009 the scheme was made available for common citizens as well. The scheme is strategically designed to strike balance between return and risk, in order to ensure optimum return while safeguarding the investment against market volatility.

National Pension Scheme (NPS) has been discussed in my previous articles as well; the links has been shared below.

National Pension Scheme (NPS) All Citizen Model was introduced in 2009. It is a low cost, tax efficient retirement plan wherein Subscriber contributes towards his/her superannuation fund. In this post will look into the salient features of National Pension Scheme (NPS): All Citizen Model.

Applicability: National Pension Scheme (NPS)

National Pension Scheme is open to all the citizens of India, irrespective of whether they are resident or non-resident and are aged between 18- 65 years at the time of subscription.

Administrative Authority

The scheme is administered on behalf of Government of India by Pension Fund Regulatory and Development Authority (PFRDA).

Eligibility

Any citizen of India, whether resident or non-resident aged between 18- 65 years at the time of subscription, may join the scheme either as an Individual or Corporate Group (Employee-Employer relation), subject to submission of all required information/forms and complying with Know Your Customer (KYC) document.

After attaining 60 years of age, Individual may continue contributing to the NPS account till the age of 70 years.

Subscription to the National Pension Scheme (NPS)

Subscription to NPS may be made through designated branches of almost all the leading banks (both private and public sector) along apart from authorized financial institutions are enrolled to act as Points of Presence (POP’s). Individuals are required to open a NPS account through the Point of Presence (POP) and who will assist Subscribers with all the details, forms required to open the account.

The designated branches of Points of Presence (POPs) are the first point of contact for Subscribers. The authorized branches of a POP, called Point of Presence Service Providers (POP-SPs), will not only act as collection points but will also be responsible for number of other customer services including withdrawal from NPS.

POP-SPs location can be accessed from the link mentioned below:-

https://www.npscra.nsdl.co.in/pop-sp.php

Online Subscription (eNPS) is also available for Subscribers who wish to open their account online. Please visit the link provided below for more updates.

https://enps.nsdl.com/eNPS/LandingPage.html

Documents Required

The following documents need to be submitted to the POP-SP at the time of Subscription to the Scheme:-

#Registration Form (duly filled)

#Identity Proof

#Address Proof

#Age Proof

#Cancelled Cheque of respective Bank

#Subscription Amount (Rs 500/- minimum)

For e-NPS (Online), Subscribers have to submit the KYC documents to the respective bank branches.

PRAN Generation

Subscriber on submission of mandatory documents along with the initial subscription amount will receive a 17 digit acknowledgement number from the respective POP-SP. This acknowledgement number is generated by Central Recordkeeping Agency (CRA). Subscriber may check the status of the application by using the acknowledgement number.

Link to check PRAN Status: https://cra-nsdl.com/CRA/

On generation of PRAN number (12 digit), notification will be sent on the registered mobile number and email id of the subscriber.

Types of Accounts under National Pension Scheme (NPS)

Under NPS, Subscriber has the option to invest in two types of Accounts, namely Tier-1 (Mandatory) and Tier-2 (optional).

Tier-I: It is mandatory for the Subscribers to open the Tier-1 account. The contribution to this account cannot be withdrawn before the completion of the tenure and restriction is imposed on withdrawal. The contribution is eligible for Tax Deduction.

Tier-II: It is a voluntary investment account which does not have any withdrawal restrictions and contribution made to this account is not eligible for Tax Deduction (Non Government Subscribers). It is an additional investment window for subscribers.

Contribution to National Pension Scheme (NPS)

Contributions (For Tier-I)

Minimum Contribution on account opening and for all subsequent transactions: Rs 500/-.

Minimum Contribution per Financial Year: Rs 1,000/-.

Number of Contribution in a Financial Year (Minimum): 01

No restriction on Maximum Contribution.

Contributions (For Tier-II)

Minimum Contribution on account opening and for all subsequent transactions: Rs 1000/- (Account opening) and Rs 250/- (subsequently).

Minimum Contribution in a Financial Year: NA

Number of Contribution in a Financial Year (Minimum): NA

No restriction on Maximum Contribution.

Investment

Subscriber has the option to choose from Auto or Active choice for his/her investment. Subscriber is allowed to allocate the contribution in to the four asset classes (Equity Fund, Government Bonds, Corporate Debts and Alternative Investment Funds). However, the fund will be managed by a single Pension Fund Manager (PFM) out of the available list of PFM’s shared below.

Four Types of Asset Classes for Investment

E Class: Investment in Equity Oriented Instruments

G Class: Investment in Government Bonds & Securities

C Class: Investment in Corporate Debts & related Instruments

A Class: Investment in Alternative Investment Fund (AIF) which includes instruments like Real Estate Investment Trusts (REITs), Infrastructure Investment Trusts (InvITs), Mortgage-Backed Security (MBS), Commercial Mortgage-Backed Security (CMBS), etc.

Active Choice

Subscriber has the option to design the portfolio depending on their appetite for risk and return, by allocating funds to the respective class of assets for Investment. Individual is allowed to invest maximum up to 75% of the contribution in E Class (Equity Oriented Instruments), and rest to be balanced among other asset class, such as G Class (Government Securities), C Class (Corporate Debts and Related Instruments), A Class (Alternative Investment Funds).

#Subscriber is allowed to invest 75% of the investment in Equity till the age of 50 years.

#From 51 years of age, equity allocation is reduced by 2.5% every year till the age of 60, to reduce the equity exposure to 50%.

#Contribution in A Class Fund is restricted to maximum up to 5%.

#Investment limit allowed in Asset Class C & Class G is permissible up to 100%.

#Total Investment Allocation across the specified asset class must be equal to 100%.

Auto Choice (Life Cycle Fund)

In case subscriber does not exercise any choice of allocation, their fund will be invested in accordance with the Auto Choice option. In this option, the investments will be made in different asset class based on Subscriber’s age. Here, the allocation of funds in the three asset classes will be determined by a pre-defined portfolio in accordance with age. Subscriber has three Auto Choice Fund option available, Aggressive Life Cycle Fund, Moderate Life Cycle Fund, Conservative Life Cycle Fund.

Investment may be made in the following classes based on the preference of the subscriber.

LC75-Aggressive Life Cycle Fund: Maximum exposure in Equity Investments is capped at 75% till 35 years of age, post which the exposure to equity is reduced by 4% to 1% on yearly basis to be capped at 15% by the age of 55 years and thereafter. During the same period the investment in G Class assets is gradually increased, as allocation touches 75% on attaining 55 years of age.

LC50-Moderate Life Cycle Fund: Maximum exposure in Equity Investments is capped at 50% till the age of 35 years, post which the exposure to equity is reduced by 2% every year to be capped at 10% by the age of 55 and thereafter. Allocation to G Class assets gradually increases every year after the age of 35, investment allocation is 80% when the Subscriber is 55 years old.

LC25-Conservative Life Cycle Fund: Investment in Equity is capped at 25% till 35 years of age. The Equity exposure is reduced by 1% every year thereafter till the age of 55 years, when the exposure is restricted to just 5%. Being a conservative Fund, allocation to G Class assets is 90% on and after attaining 55 years of age.

Subscriber has the option to select any one from the following Pension Fund Managers (PFM) to manage their Investment:-

#LIC Pension Fund

#ICICI Prudential Pension Fund

#Kotak Mahindra Pension Fund

#Reliance Capital Fund

#SBI Pension Fund

#UTI Retirement Solutions Pension Fund

#HDFC Pension Management

#DSP Blackrock Pension Fund

SBI Pension Fund is default Pension Fund Manager.

Subscriber has the option to change his/her preference for allocation and Fund Manager in the future.

Subscribers also have the option to choose different Fund Manager for Tier1 and Tier 2 account respectively.

Benefits of Investing in National Pension Scheme (NPS)

It is one of the low cost Retirement benefit plan.

Investment is professionally managed by Fund Managers.

Diversification of Funds aims at mitigating risk and at the same time providing optimal return on Investment.

Restriction on Withdrawal (Tier -1) ensures that Retirement corpus does not lose out on its objective.

The account is portable and may be accessed from any location in India.

Nomination

Nomination can be made at the time of registration and one may add up to 3 nominees. In case of more than 1 nominee, Subscriber will have to declare the percentage of fund allocated to the respective nominees. Nominees may also be changed latter, after the PRAN has been generated.

Tax Benefit

The Investment in National Pension Scheme is eligible for Tax Deduction U/S 80 CCD (1B) for Rs 50,000 up and over the Deduction available U/S 80C of Rs 1,50,000/- from the Financial Year 2015-16.

Withdrawal fund up to 60% of the total NPS Corpus is exempted from purview of Income Tax, as announced on 8th December 2018, effective from 1st April, 2019. The amount vested in purchasing an annuity plan is also exempted from tax but the periodic payout or the annuitized returns is taxable. Previously, only 40% of the withdrawal amount was exempted from income tax, rest 20% of the withdrawal fund was taxable. Thereby, now NPS is also partially an exempt-exempt-exempt (EEE) scheme, as the investment, return and lump sum withdrawal (60%) is exempted from tax. However, the annuity income from the fund vested in an Annuity Plan remains taxable as per the existing Income Tax Slab.

In the Budget 2017, It was announced that contribution of up to 20% of the gross income of a self employed can be deducted from taxable income U/S 80CCD (1) to bring it at par with the benefit enjoyed by the Salaried Class.

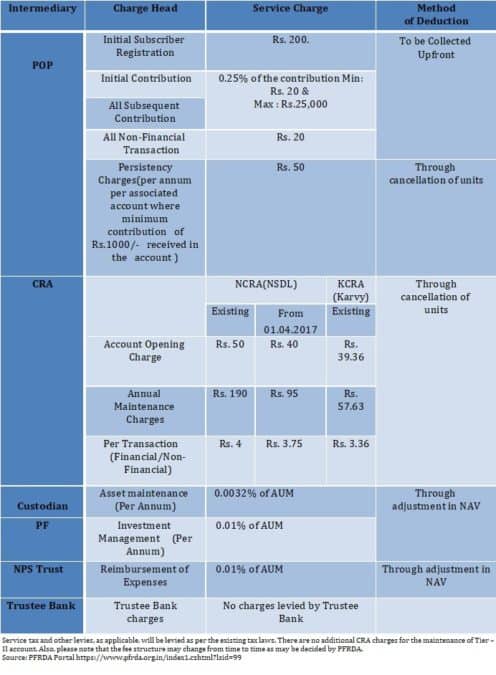

Charges and Penalties

Unfreeze/Reactivate Account: If the minimum contribution and balance criteria is not maintained the account is liable to be deactivated/frozen. In order to reactivate/unfreeze, Subscriber needs to submit a request form (UOSS10A) along with minimum of Rs 600. Out of which Rs 100 will be charged as penalty to unfreeze/reactivate and rest will be allocated to your portfolio.

Withdrawal/Exit

Subscribers are not allowed to withdraw from the Tier-1 scheme before attaining the age of 60 years. However, if a Subscriber opts to retire before the completing 60 years of age or does not want to continue with the scheme then, Subscriber has to utilize at least 80% of the accumulated retirement wealth for purchasing a retirement annuity (providing monthly pension to the subscriber) while the rest of the fund will be paid as lump sum to the subscriber.

Subscribers withdrawing post the age of 60 years, will have to invest at least 40% of the savings to purchase a pension annuity while the rest could be withdrawn as lump sum.

On attaining 60 years of age, Subscriber has the option to continue with the contribution, withdraw, or remain invested. Subscriber is allowed to remain invested till the age of 70, post which the entire lump sum withdrawal fund will be transferred to the respective bank account as full and final settlement.

In the unfortunate event of death of the subscriber, the entire accumulated pension wealth (100%) would be paid to the nominee / legal heir of the subscriber and there would not be any purchase of annuity/monthly pension.

Conditions for Partial Withdrawal of Funds

Partial withdrawal from NPS account is allowed subject to fulfillment of following conditions:-

One should have remained actively invested in NPS for 10 years.

Amount of withdrawal should not exceed 25% (includes 40% total limit) of your total investments.

Withdrawal can only be allowed against specified reasons.

Withdrawal will be allowed only 3 times during the entire tenure of subscription with a gap of 5 years between two partial withdrawals.

Annuity may be purchased from any one of the following companies licensed by IRDAI (Insurance Regulatory Authority of India) and empanelled by PFRDA to act as Annuity Service Provider.

Life Insurance Corporation of India

SBI Life Insurance Co. Ltd.

ICICI Prudential Life Insurance Co. Ltd.

Bajaj Allianz Life Insurance Co. Ltd.

Star Union Dai-ichi Life Insurance Co. Ltd.

Reliance Life Insurance Co. Ltd.

HDFC Standard Life Insurance Co. Ltd

List will be upgraded as more and more Companies get empanelled.

Documents Required for Withdrawal

Withdrawal Form duly filled along with following documents;

PRAN Card

Identity Proof

Address Proof

Cancelled Cheque

Grievance Redressal

Grievance may be raised through a telephone call to CRA toll free helpline number (1800222080) or through the CRA portal (www.cra-nsdl.com).

This article is for informational purpose only. Readers are advised to research further to have detailed knowledge on the topic. It is very important to do your own analysis and consult your Financial Advisor before arriving at any conclusion.

I’m not sure why but this website is loading extremely slow for me. Is anyone else having this problem or is it a problem on my end? I’ll check back later on and see if the problem still exists.

Thanks for your posting. One other thing is the fact that individual American states have their own personal laws of which affect people, which makes it very difficult for the Congress to come up with a brand new set of recommendations concerning property foreclosures on people. The problem is that every state has own guidelines which may have interaction in an unfavorable manner on the subject of foreclosure insurance policies.

I appreciate, cause I found just what I was looking for. You’ve ended my four day long hunt! God Bless you man. Have a nice day. Bye

There are some attention-grabbing points in time in this article however I don?t know if I see all of them heart to heart. There is some validity but I’ll take maintain opinion till I look into it further. Good article , thanks and we want more! Added to FeedBurner as nicely

Have you ever thought about publishing an ebook or guest authoring on other blogs? I have a blog centered on the same ideas you discuss and would love to have you share some stories/information. I know my subscribers would enjoy your work. If you’re even remotely interested, feel free to shoot me an e-mail.

Thanks for your write-up. What I want to point out is that when you are evaluating a good on the internet electronics go shopping, look for a internet site with complete information on key elements such as the personal privacy statement, security details, any payment procedures, as well as other terms and also policies. Usually take time to see the help and FAQ segments to get a superior idea of the way the shop is effective, what they are capable of doing for you, and in what way you can make the most of the features.

Hi this is somewhat of off topic but I was wondering if blogs use WYSIWYG editors or if you have to manually code with HTML. I’m starting a blog soon but have no coding know-how so I wanted to get guidance from someone with experience. Any help would be greatly appreciated!