Employees’ State Insurance (ESI) Scheme

- Posted By Amritesh

- On June 19th, 2019

- Comments: 9 responses

Employees’ State Insurance (ESI) Scheme was introduced with the objective of providing the workers, employees with proper medical care and benefits. The Act has been amended from time to time to extend benefits to more and more employees/workers so as to provide them with a medical cover. ESI is enacted as a part of Social Security and Welfare measure which would provide protection to the working population especially the lower income group in the society.

The ESI Corporation (ESIC) manages the Fund as per the regulations & provisions of the ESI Act, 1948. ESIC is autonomous body formed under Ministry of Labour & Employment, Government of India.

Employees covered under the ESI Scheme are entitled to Medical benefit for self and their dependents. ESI members are also eligible for Disablement and Unemployment Cash Benefit as per the provisions laid down under the ESI Act.

Scope & Applicability of Employees’ State Insurance (ESI) Scheme

The Employees’ State Insurance Act (ESI) applies to non-seasonal factories employing 10 or more persons. The provisions of the Act are extended by the respective State Governments in their region. The Act contains provision which empowers the “appropriate government” to extend the provisions of the Act to other classes of establishment namely industrial, commercial, agriculture or any other as specified.

The Government has extended the provisions of the Act to shops, hotels, restaurants, cinemas including preview theatres, road motor transport undertakings, newspapers establishments, educational and medical institutions employing 20 or more employees. Many of the State Governments have reduced the threshold of coverage of shops and other establishments to 10 or more persons.

Expenditure on medical care is shared between ESI Corporation and the State Government in the ratio of 7:1 within the prescribed ceiling which is revised from time to time.

An employer/establishment covered under the ESI Act is exempt from the provisions of Maternity Benefit Act and Workmen’s Compensation Act.

Exclusion

An “appropriate government” may grant or renew exemption under Section 87 of the Act in respect of a Factory/Establishment or class of factories or establishments in any specified area if the employees in such factory/establishment are in receipt of benefits substantially similar or superior to the benefits provided under the Act for a period not exceeding one year. Provided that an application for renewal shall be made three months before the date of expiry of the exemption period and a decision on the same shall be taken by the appropriate Government within two months of receipt of such application.

Exemption under Section 88 of the Act may be granted to employees or class of employees who remain away from their Head Quarters for more than 7 months in a year and those who are posted in non-implemented areas (ESI Act not applicable locations).

Eligibility

ESI Act covers Employees/Workers of factories and establishments drawing monthly wages up to Rs 21,000/- per month and Rs 25,000 /- per month for physically challenged employees w.e.f. 01.01.2017 under the scheme. Government of India fully bears the employers’ contribution for 3 years in case of physically challenged employees.

Statutory Body (Powers)

The provisions of the ESI Act are administered both by the Central and the State Governments. Establishments controlled by the Central Government are railways, mines, port and oil fields. The rest of the establishments are controlled by the State Government. Central Government is the main decision making body, although State Governments are also empowered to regulate in certain matters.

ESI Scheme is thus monitored by an autonomous body appointed by the Central Government. The autonomous body is bestowed with the task of improving the health facility, and to provide them with adequate Health Facility and reduce financial liability.

Registration of Employees & Establishment/Factory

The Employer should get the factory or establishment registered with the ESI Corporation at the respective Regional Office within 15 days of the applicability of ESI Act.

All the employees entitled to the benefits under the Act, are required to insured as per the rules laid down in the Act. After completion of the registration procedure every employee covered under the Act should be provided a Permanent Identity Card. This card is to be issued to those employees who have been in employment for more than 3 months, till this time he/she will be allotted a Temporary Identification Number.

Contribution to Employees’ State Insurance (ESI) Scheme

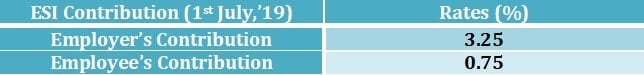

The ESI Scheme is financed and functions largely through contributions from employers and employees. The rate of contribution by employer was 4.75% of the wages payable to employees/workers. The employees’ contribution was at the rate of 1.75% of the wages payable to an employee/worker. The State Governments also shares part of the expenditure on the provision of Medical Care. Thus, the aggregate contribution rate was 6.50% for the period ending 30th June, 2019.

Government has issued notification to reduce the contribution rates for the Employers as well as Employees effective from 1st July, 2019. The revised ESI contribution rate is 3.25% for the Employer and 0.75% for the Employees. Thereby, Total Contribution being 4% revised from 6.5%. In February,’19, Government had issued a draft to reduce the contribution rate for Employer to 4% and 1% for the Employees.

However, the Government had previously reduced the contribution rate to 3% for employers and 1% for employees under Rule 51B in areas where the Act was to be implemented for the first time. This concessional rate of contribution would continue for initial 24 months.

An Employer is liable to pay the Contribution to the ESI Corporation within 15 days (21 days before June,’17) of the last day of the calendar month in which the contributions fall due.

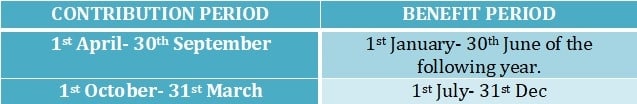

Contribution & Benefit Period

The period during which an employee/worker is entitled to, or avails of a benefit is called the “Benefit Period”. The amount of benefit is calculated with respect to the contributions paid during the corresponding “Contribution Period”.

Benefits under Employees’ State Insurance (ESI) Scheme

The employees/workers are eligible for the following benefits under the Scheme. ESI Benefits are discussed in detail in the link shared below.

Benefits under ESI Scheme

#Medical Benefit for the Insured and Family Members.

#Sickness Benefit

#Maternity Benefit

#Disablement Benefit

#Dependent’s Benefit

#Funeral Expenses

#Rehabilitation Allowance

#Unemployment Allowance

Grievance Redressal System

ESI Corporation has set up the Public Grievances Redressal System at its Headquarters along with Regional Offices, ESI Hospitals & Dispensaries. In order to ensure expeditious disposal of complaints and grievances under the ESI Scheme, various measures have been taken by the Corporation.

Aggrieved Employee can also appeal to the Employee Insurance Court or even to the High Court within the stipulated time frame, in case he/she is not satisfied with the order.

This article is for sharing personal views only. Readers are advised to research further and consult a Labour Law Expert to have more clarity on the topic.